How Far Will Apple Fall From The Tree?

With the recent conclusion of the FOMC meeting, the market can breathe a collective sigh of relief as some of the prevailing uncertainty dissipates. However, amidst the ongoing earnings season, where many companies are surpassing revenue expectations, concerns loom over future guidance, particularly if interest rates remain elevated. Let’s delve into the implications and potential outcomes for the upcoming week.

I’ve been writing about the roller coaster of a market, and the recent FOMC meeting was no exception. Here’s a 10-minute chart and you can see the initial reaction after the meeting and the subsequent collapse about two hours later.

What happened? Well, Fed chair Powell said no change in rates. More importantly, no need to increase rates for now, despite inflation not getting to the 2% goal as fast as they’d like.

If that’s good news, why did the market suddenly reverse course? The analysts on Wall Street were left with no path forward. Essentially, the Fed said rates could be cut, stay the same, or go up depending on economic factors. Instead of a concrete answer, they got a Fed that isn’t confident enough to tell people what their path forward will be.

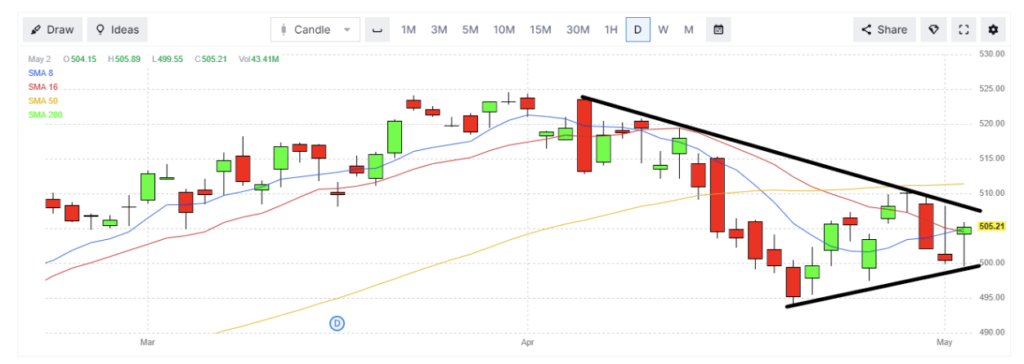

The pivotal question arises: can tech giants like Apple salvage market sentiment? While the S&P 500 has exhibited signs of stability, with higher lows since mid-April, concerns persist regarding downward pressures. The S&P 500 has seen lower highs, but higher lows going into Apple’s earning announcement.

With expectations of a 5% decline in Apple’s revenues, the company’s prospects hinge on breakthrough innovations, such as AI integration, to offset challenges in the Chinese market.

Analysts expect about a 5% drop in Apple revenues, which would make this the fifth in the last six quarters with a drop in revenues.

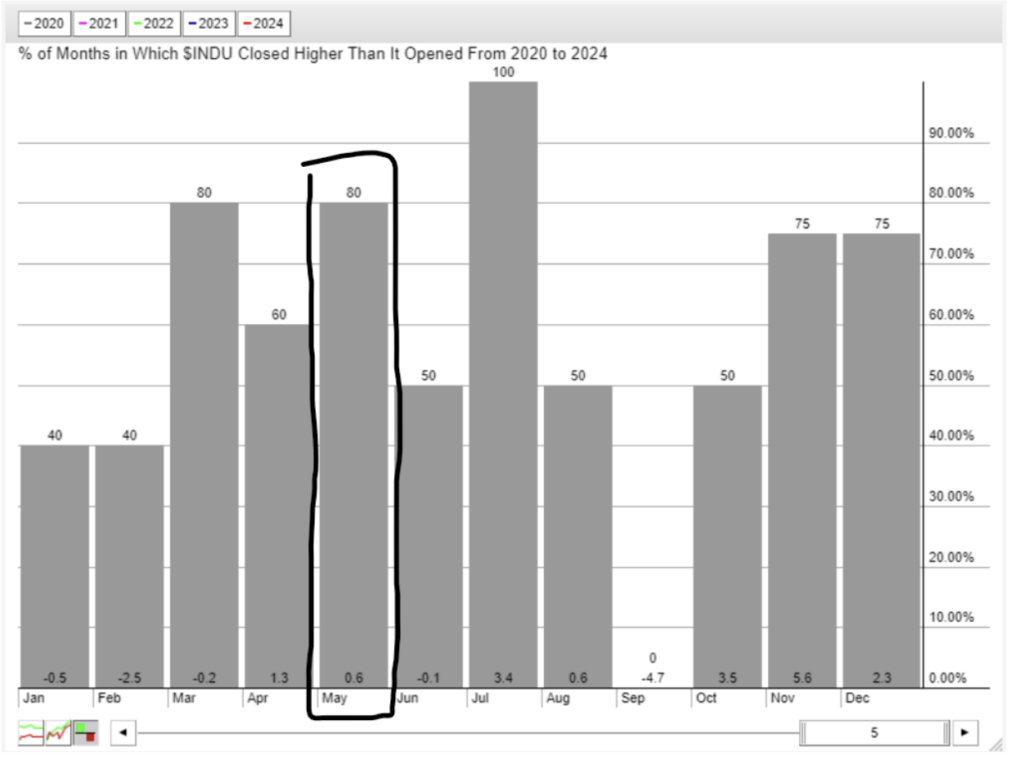

The last bit of technical information I’ll leave you with is that we have entered into the “Sell in May and Go Away” phase of the calendar year. But what does seasonality tell us? I’m more inclined to take a vacation in June rather than May. Here’s why.

Over the last 5 years, May has finished higher 80% of the time, with an average monthly gain of 0.6% in the S&P 500. Look at what happens in June! Och. It’s a 50-50 shot with a negative average gain. July comes roaring back with a 100% win rate and an average gain of 3.4%. Of course, past performance doesn’t mean anything, but it’s nice to see that May isn’t necessarily a bad month

As I’ve been writing about for a couple of weeks, I expect turbulent trading days where the market oscillates up 1% a day and falls back down soon after. The major indices need to break out of their sideways to lower trend channels, so until then, be careful. I’m keeping trade sizes down and taking a variety of trades in different asset classes until a clearer picture forms.