Goldilocks Environment or Bull Trap?

The S&P 500 put the April dip behind it as it rose to new highs this week. The bulls have overtaken the bears as investors take any bit of economic information as a sign that rate cuts are coming soon. Are we in a Goldilocks environment or does something wicked this way come? Where might the market head next with the bulls in control? Let’s take a look at that and more!

April’s dip was largely fueled by concerns that disinflation had stalled, so all it took this week were a few reports that said the economy is slowing but at an ok rate of decline. Investors think that the rate of decline is enough that a rate cut in September should be in the cards. Although I still find a rate cut before a U.S. election unlikely.

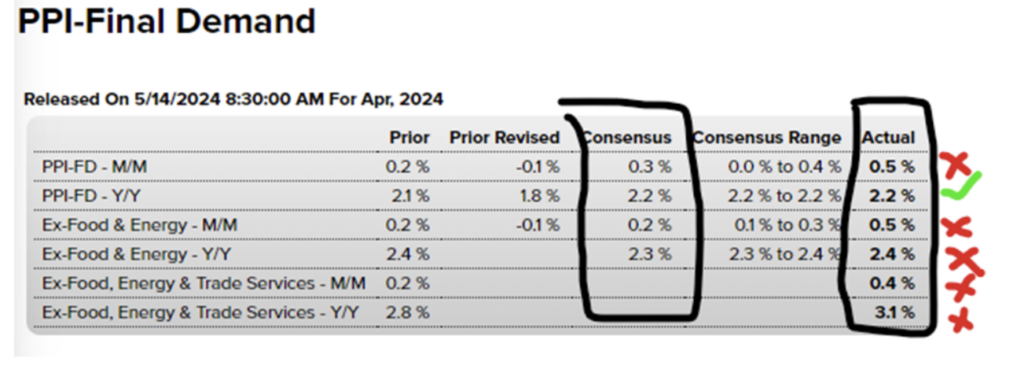

The Producers Price Index showed that prices went higher than expected, but investors largely shrugged off the numbers as “not great, but could have been worse.”

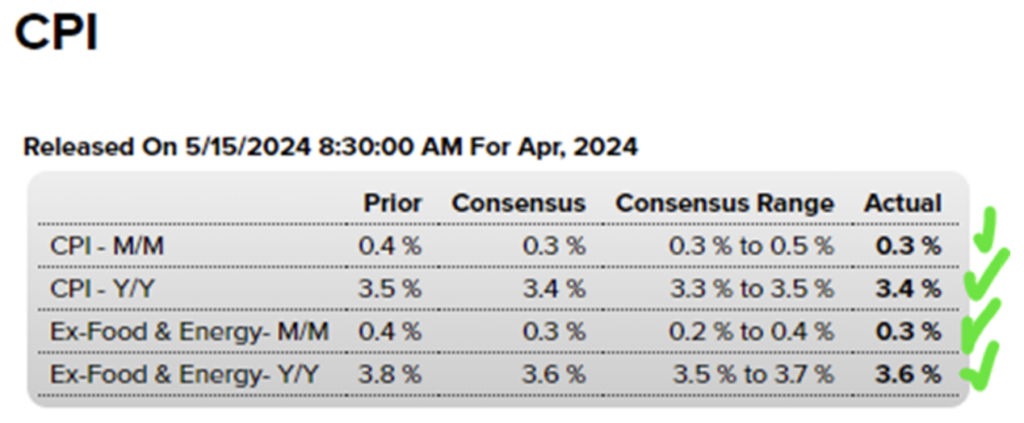

Next came the Consumer Price Index which showed that Consumer Prices are in line with expectations, but notice a year-over-year gain of 3.4% doesn’t bode well for families on a budget, especially if jobless claims and a slowing economy is here for a few more months. Did you get a 3.4% raise this year to cover the extra cost of goods? Yet investors were happy about that number.

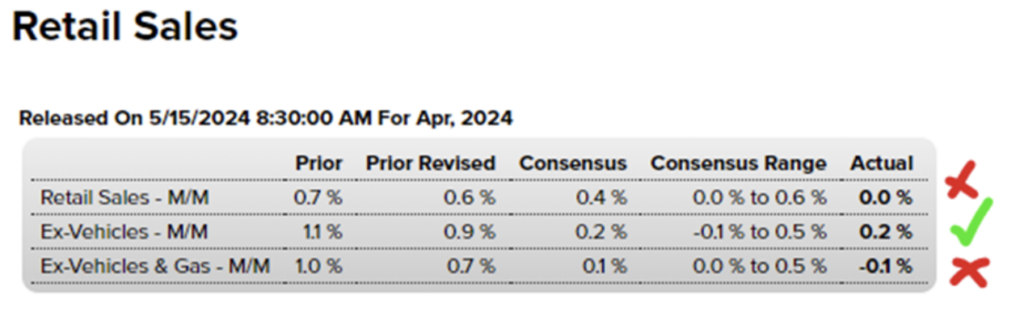

Finally, retail sales came in anemic, at best. But overall that was taken as information supportive of future rate cuts. Growth is slowing and that’s a good thing in the near term.

That was enough short-dated economic data to help investors believe we are in a near-perfect Goldilocks environment, where we have stable (albeit declining) growth, falling inflation (really?), future Fed rate cuts (not so sure about that), and continued AI enthusiasm (rise of the chatbots!). The markets took off and broke out to new highs, clearing a major level of resistance.

While markets don’t normally care about what is happening now – they price in future projections of what a company may be worth – this market doesn’t seem to want to be bothered by where things are going beyond the shorter term.

I’m all for not fighting the trend and trading what the tape gives you, but I do think this market is still open to a rollercoaster ride that will contain wild bullish days followed by a fall at the slightest negative news.

With the Volatility Index back at sub-13 levels, it will be easy to get lulled into a false sense of security. Managing volatility, while trading the trend of the market is where I’ll be.

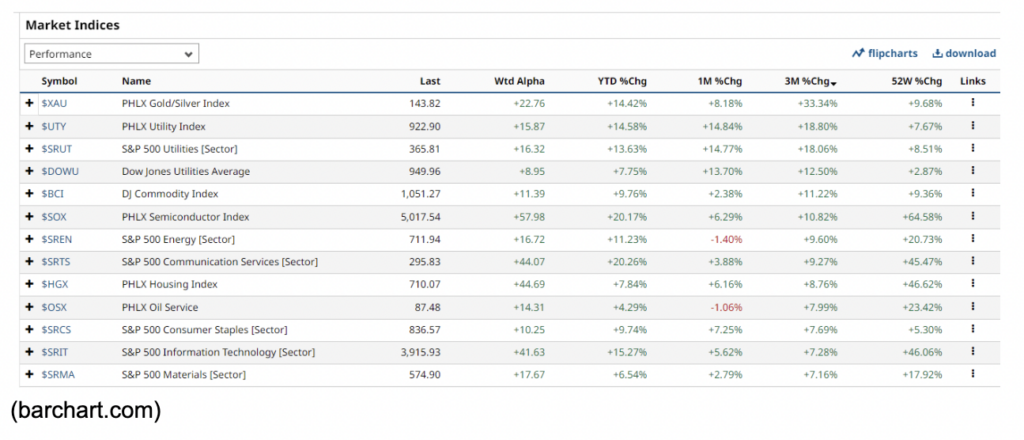

Over the last three months, some of the best-performing sectors have been defensive – Gold/Silver, Utilities, Energy, and so on. I expect these to stay at the top of the recent performers list.

If the bulls continue to take charge, look for the S&P 500 (SPY) to head to $553, and find support around $523 and $517.

Other investors are calling for a bull trap and if you’re anything like Trader Jack (my dad), for months he’s been calling for the Dow to hit $40,000 before falling back down to $38,800 or lower. He was right about the first part. Will he be right about the second?

It may be time to look at bonds again. The TLT ETF broke out of a long-term lower trend line, but there’s a good fundamental reason to look at them as well. If slowing growth doesn’t stop and we get a growth scare higher, bonds will outperform. If inflation and growth drift lower, bonds should rally with the rest of the market.

Maybe we are in a Goldilocks situation. Growth isn’t great, but the job market isn’t horrible. Stocks are up, but CEOs have warned about future guidance. Disinflation has slowed, but not stalled out. Consumer spending is down, yet credit credit debt is out of control.

Yet somehow, the economy keeps pushing forward. Maybe we are exactly where we need to be. And for me, that’s getting ready for a glorious weekend ahead.

See you next week!