The S&P 500 rose 1.6% in January, as stocks logged their third straight month of gains. Much of investors’ optimism hinges on upcoming rate cuts, which based on recent comments from Federal Reserve members, will not be coming in March.

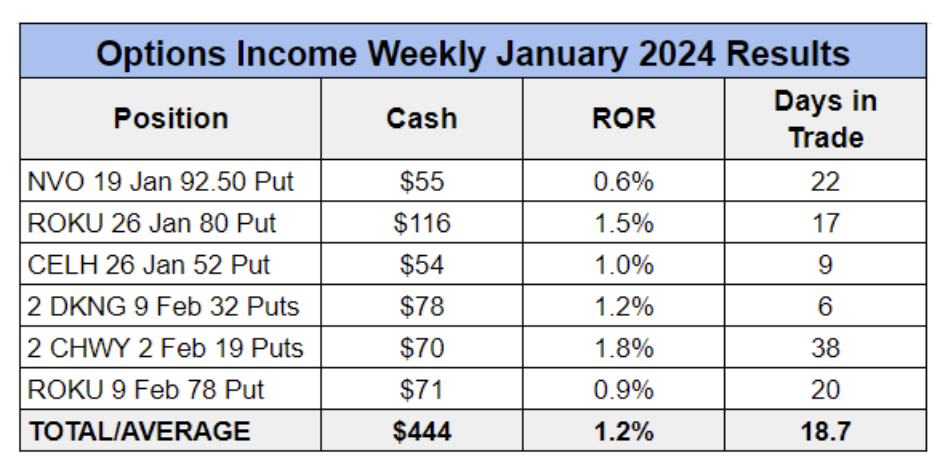

Options Income Blueprint members closed six winning trades in January, pocketing $444 in cash for the month and averaging a 1.2% return per trade.

To kick off February, Options Income Blueprint members closed their second profitable trade on digital sports entertainment and gambling company DraftKings (DKNG).

We have traded this speculative stock in the past, usually coinciding with major sporting seasons or events. In other words, this is predominately an opportunistic trade where we look to capitalize on increased investor interest and bullish momentum by selling options to capture premium.

For instance, DKNG tends to perform well in the July-to-August timeframe in anticipation of the upcoming NFL season, which drives a lot of interest in sports betting companies. It also tends to do well in January, with the NFL playoffs in full swing and the Super Bowl on the horizon.

We traded DKNG successfully numerous times this past summer in Options Income Weekly and the Income Masters program. And we went back to the stock in mid-January with the goal of once again riding its momentum to profits.

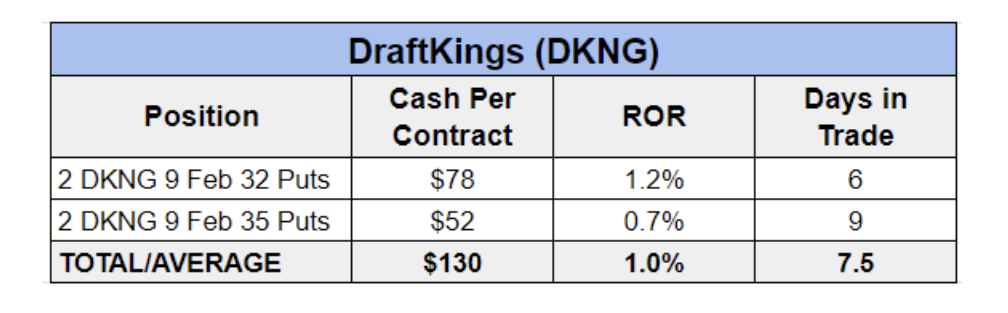

On Jan. 17, with DKNG trading around $35, we recommended members sell the DKNG 9 Feb 32 Put for $0.49, or $49 per contract, setting a target exit price of $0.10. We sold two contracts in our live account, collecting $98 in income.

DraftKings didn’t disappoint, and by the morning of Jan. 23, the stock was up 10%. The rally in shares triggered our good ‘til canceled (GTC) order to buy back the puts we sold.

We pocketed $78 in income, or 80% of the max profit. That represented a 1.2% return on the $6,400 in capital allocated to the trade ($32 strike price x 100 shares per contract x 2 contracts traded) in less than a week.

But with the Super Bowl scheduled for Feb. 11 and the company’s earnings report still a few weeks out, we decided to go back to the stock just hours later with another trade.

This time, with DKNG trading at $38.32, we recommended selling the DKNG 9 Feb 35 Put for $0.31, or $31 per contract. We set a target exit price of $0.05 and sold two contracts in our live account, collecting $62 in income.

Our target exit price was hit 15 minutes before the market close on Feb. 1. We walked away with a $52 profit on two contracts, or 84% of the max profit, exiting the position more than a week before expiration.

Between the two trades, we collected $130 in cash and averaged a 1% return per trade in just over a week.

With the Super Bowl taking place this weekend, it’s likely we won’t trade DraftKings for a while. This is the classic example of an opportunistic trade, and knowing when to take a pass is just as important as knowing when to take a swing.

The company is scheduled to report earnings on Feb. 15. While it has beaten analysts’ earnings estimates in each of the past four quarters, there’s no telling which way the volatile stock may head after the announcement, especially with the Super Bowl behind us. So, for those who are trading it on their own, be mindful of that date.

For our money, we’ll be redeploying the capital on other opportunities until the time is right to bet on DraftKings again.