Welcome to the Breakfast Club, your weekly dose of market insights and trading strategies! Join us live every Monday and Wednesday at 8:30 AM ET on Traders Reserve Live, where our experts break down the latest market movements, share actionable trade ideas, and answer your most pressing questions.

Unpacking Last Week’s Trading Successes and Key Insights

Another week of dynamic market action has passed, and at Traders Reserve, we’re here to break down our performance, share crucial lessons, and provide you with actionable insights for the week ahead. While the market presented a mixed bag of opportunities, our strategic approaches across Income Masters and Millionaires Trading Club (MTC) led to significant gains and valuable learning experiences.

A Closer Look at Our Performance and What Drove It

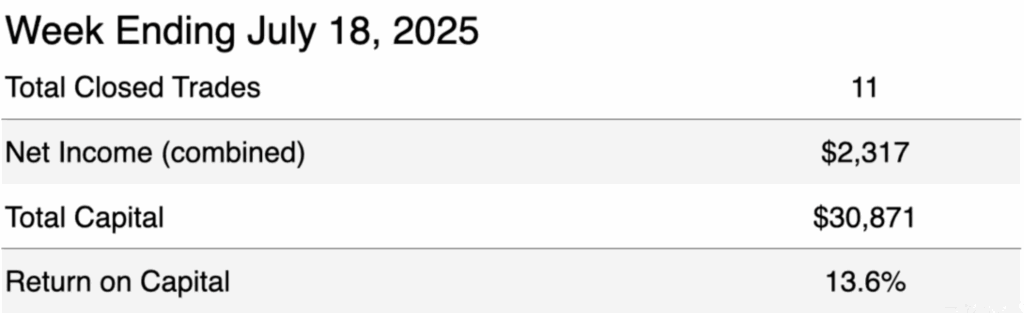

Last week saw a combined total of 11 closed trades, generating over $2,300 in net income on $30,000 of capital—that’s an impressive 13.6% return for the week!

While Income Masters experienced a slightly quieter week in terms of closed trades, as anticipated due to the “caterpillar effect” between major data releases, our Millionaires Trading Club was exceptionally active. In its second week of the new daily program, MTC closed 9 trades, with four of those closing within a single trading day! The average time in trades for new MTC positions was a remarkably swift 2.3 days, highlighting our objective of faster, more aggressive income acceleration.

The Power of Patience: A Look at the Costco Trade

One of the most instructive trades from Income Masters was a Costco position that dated all the way back to March. This trade, which took 118 days and involved nine total rolls, ultimately closed for a $500 profit. While not a “retire-on-this-trade” amount, it serves as a powerful testament to the importance of patience and strategic recovery.

The core lesson here is understanding when to commit to saving a trade versus cutting your losses. As we emphasize, there’s no black and white answer. However, leaning towards working to save trades where the company’s fundamentals are strong and the initial reason for the trade remains valid often leads to positive outcomes. Conversely, if a company’s fundamentals have deteriorated significantly, the focus shifts to recovering as much as possible and exiting the trade. This Costco example, with its strong underlying fundamentals, perfectly illustrated how persistent management can turn an initial challenge into a profitable resolution.

Millionaires Trading Club: Rapid-Fire Returns

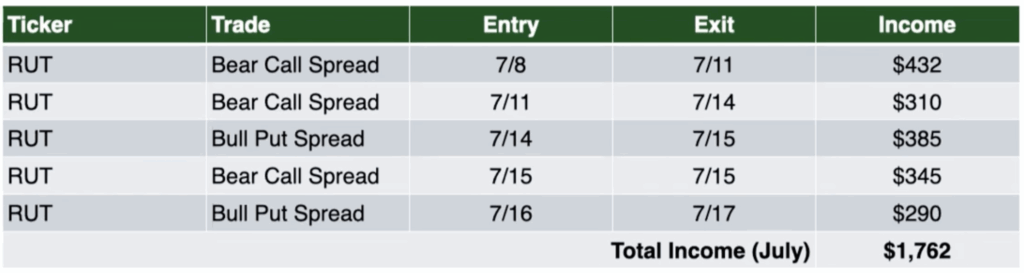

MTC’s performance was particularly strong, with 9 closed trades and an average capital per trade of around $2,700. We even saw five trades in the Russell 2000 alone yield over $1,760 in net profits this month. The Russell 2000 has become a go-to index for MTC, consistently generating excellent performance through short-duration trades.

Looking at our overall monthly progress, July is off to a spectacular start for Income Masters, with over $4,500 in income already.

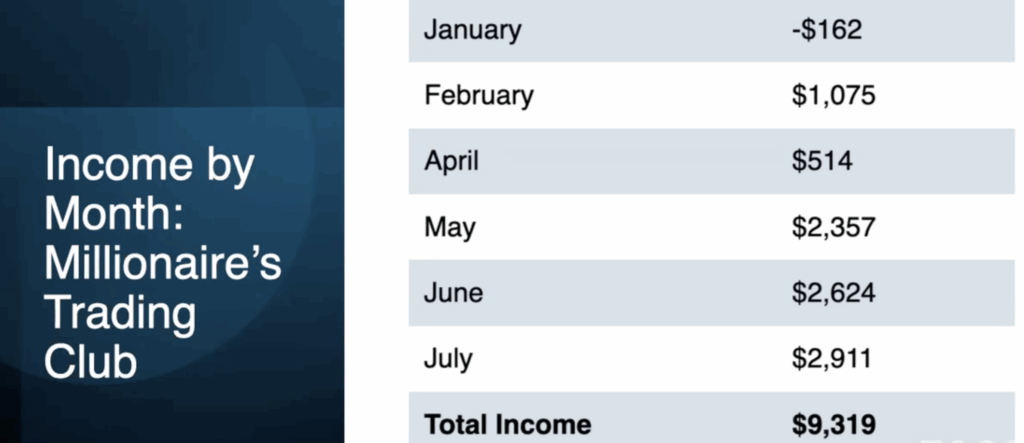

For Millionaires Trading Club, since transitioning to the new daily format, we’ve generated over $2,900 in total income, contributing to over $9,300 year-to-date. The last three months (May, June, and July) have all exceeded $2,000 per month, showcasing a quick acceleration in our results.

What to Watch This Week and How We Identify Opportunities

As we move into the week of July 21, 2025, several key factors will influence market movement:

- Earnings Season in Full Swing: Over 110 stocks are reporting earnings this week, including major players like AT&T, Verizon, Coca-Cola, General Motors, Google, and Tesla. While earnings reports can lead to unpredictable market reactions (as seen with Netflix’s recent guidance-driven dip), they also present significant trading opportunities. We analyze these reports not just for immediate impact but for underlying fundamental shifts that create long-term value.

- Economic Calendar: This week’s economic calendar is relatively light, with Federal Reserve Chair Powell speaking on Tuesday and the usual unemployment claims on Thursday. These reports generally have less market-moving power than earnings or unexpected news.

- Identifying Top Performers: We continuously scan for stocks outperforming the S&P 500 year-to-date, with strong 5-day changes and significant volume. This helps us identify potential continuation of momentum plays for short-duration trades.

- Spotting Pullback Opportunities: For those who prefer a “pullback” strategy, we look for strong companies that are currently trading below their 20-day moving average but remain above their 200-day moving average. A recent example is CVS, which despite outperforming the S&P 500 by 30% year-to-date, found itself near its 200-day moving average, presenting a potential 20% return opportunity on a weekly option trade.

- Sector Rotation: Our weekly analysis of sector performance helps us identify areas that might be overbought (like Utilities, now at 94% of stocks above their 20-day moving average) or beaten down (like Healthcare, with only 25% of stocks above their 20-day moving average). This guides our search for strong stocks within strong sectors, or potential turnaround plays in oversold sectors.

- Seasonal Trading Ideas: We also explore seasonal patterns, identifying stocks with a 90% track record of moving higher over the last 10 years during specific periods. It’s crucial to remember that these seasonal moves often coincide with earnings, so due diligence is always essential.

Join Us for Deeper Insights and Live Trading

Want to learn more about how we identify these opportunities and manage our trades?

- Attend our special Happy Hour Webinar this Thursday, July 25th, at 4 PM ET on Zoom. We’ll be focusing on overcoming fear in current market conditions and sharing details about our upcoming Millionaires Trading Club live event in October.

- Tune in for our next Breakfast Club session this Wednesday, July 23rd, at 8:30 AM ET.

- If you’re already a member, remember that Income Masters meets today at 12:30 PM ET and Millionaires Trading Club at 11:00 AM ET.