Welcome to the Breakfast Club, your weekly dose of market insights and trading strategies! Join us live every Monday and Wednesday at 8:30 AM ET on Traders Reserve Live, where our experts break down the latest market movements, share actionable trade ideas, and answer your most pressing questions.

The Weekly Income Report: A Look Inside the Millionaires Trading Club 📈

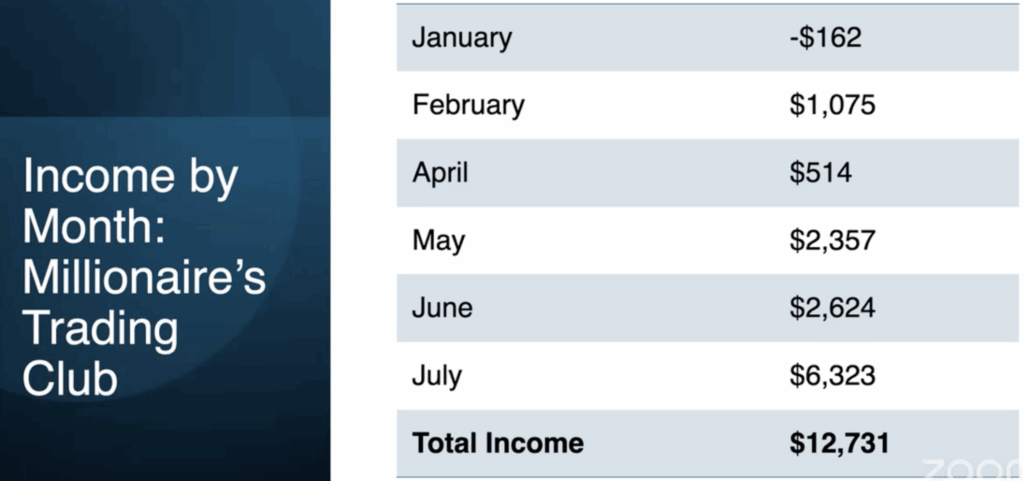

How do we make money in a volatile market? By focusing on data-driven strategies and consistent results. This week, our weekly income report shows you exactly how our members are navigating market uncertainty. Our trading services, the Millionaires Trading Club and Income Masters, have delivered strong returns.

Millionaires Trading Club: In July, we had a total income of $6,323, closing 33 out of 42 trades with a 100% win rate, a testament to the power of our strategy. We achieved a remarkable 10.9% return for the last week on just four trades, using neutral strategies like bear call spreads and bull put spreads.

Income Masters: This service had a banner month in July, generating over $2,300 in net income over a two-week period.

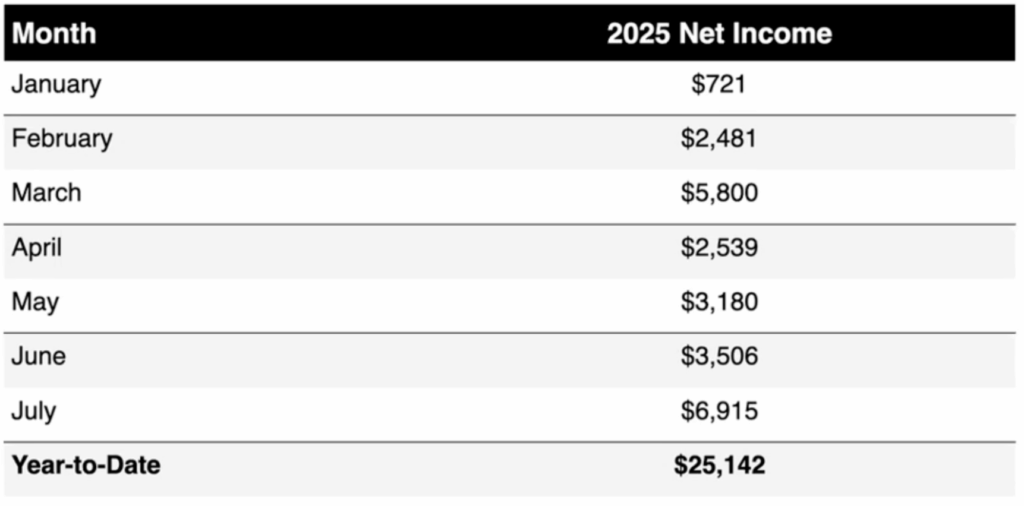

As you can see below, Income Masters has a combined net income of over $25,000 year-to-date for its members!

We’re also observing what we call the “caterpillar effect” in our trading—the process of opening and closing trades as capital becomes available. We track this to help our traders optimize their capital exposure, ensuring we’re never over-leveraged while constantly seeking new opportunities.

August Outlook: Is the Jobs Report a Market Trap? 🤔

As the calendar turns to August, the market finds itself at a crossroads. Just a week after an explosive earnings season, a surprise jobs report and new tariffs have created a cocktail of uncertainty. At Traders Reserve, we believe in cutting through the noise to focus on the data that truly matters.

The market’s recent dip follows a jobs report that was far weaker than expected, leading to a period of caution. Despite a slight recovery in futures, our analysis suggests that a single data point doesn’t make a trend. We’re looking beyond the headlines to a new dichotomy: the Federal Reserve’s potential rate cuts and the administration’s claims of a strong economy. As one of our experts notes, “You don’t cut interest rates when the economy is strong and growing.”

Decoding the Data: What’s Really Moving the Market

The Bureau of Labor Statistics (BLS) is under scrutiny after a massive downward revision of jobs numbers. This has created a potential “lack of trust in the numbers” at a time when the stock market is particularly sensitive to economic data.

Here’s the data we’re watching closely:

- ISM Services Report: This is our most important metric this week, as the service sector accounts for over 60% of the U.S. economy. The report must stay above 50% to signal continued expansion.

- Tariff Revenue: While tariff revenue is up, the big question is whether this trend is sustainable or if it will lead to reduced consumer spending as prices increase.

Seasonal Shifts and Sector Rotation for August 📊

August and September have historically been the weakest months of the year for the stock market. This isn’t a guarantee of a crash, but it’s a powerful warning to exercise caution.

- Sectors to Watch: Our analysis shows that defensive sectors like communication services and utilities have historically performed better in August. Meanwhile, sectors like the Russell 2000 have a greater than 60% chance of a negative month. This suggests that a strategy of sector rotation—moving capital from riskier to more defensive areas—could be prudent.

We’ll be back Wednesday morning at 8:30 AM EST on “Breakfast Club Live” with more market insights. But don’t wait.

Don’t just watch the market. Take your piece. Join Traders Reserve today.