We’ve talked recently about the challenges facing option sellers amid record-low volatility. Option premium has become harder to find as the VIX hovers near record lows, and we’ve been adapting to meet that challenge.

For instance, in the Income Masters program, we recently added another spread strategy to our toolkit. However, we don’t trade spreads in the Options Income Weekly program. There we stick to straight put and call selling. So, we’ve had to adapt in other ways to find attractive premiums.

Looking at the two-year chart of the VIX below, you can see we’ve been contending with low volatility for the better part of 2024.

We did get a spike in VIX in April, as the broader market fell more than 4%. But, by mid-May, VIX was back languishing around the 12 level.

This had us on the hunt for some alternative assets to trade and we went back to one we had traded in the past: Bitcoin (BTC).

Bitcoin certainly isn’t the first thing most people think of when trading a relatively conservative income-generation strategy. Unlike traditional currencies, the cryptocurrency is not backed by most governments or central banks. It lacks any inherent value, which means its price is determined solely by supply and demand. However, like other commodities such as silver and gold, the cryptocurrency moves somewhat independently of the stock market, providing diversification benefits.

The other thing that makes Bitcoin risky is that it is largely unregulated, as the government is still grappling with whose purview it falls under and how to regulate cryptocurrencies in general.

Yet, amid this uncertainty, the Securities and Exchange Commission has approved a number of physically-backed Bitcoin ETFs and futures-based Bitcoin ETFs that offer traders an easier way to gain exposure to the cryptocurrency with potentially less risk and lower fees.

Our preferred way to trade the cryptocurrency in Options Income Weekly has been with the futures-based ProShares Bitcoin Strategy ETF (BITO). It currently has more than $2 billion in net assets, although it trades well below its all-time high.

But we’re not so concerned with the long-term price movement of the ETF. Rather, we’re focused on what the fund can offer us in the way of option premium. And on May 21, with the VIX hitting a low of 11.84, BITO had an Implied Volatility Rank (IVR) of 49% and was presenting a juicy trade setup.

Now, as I mentioned, this wasn’t our first time trading BITO in the Options Income Weekly program. We began trading the fund back in November, when it was around $19 per share, selling multiple put contracts given the low capital commitment. We closed that position with a 0.7% return in 16 days.

We traded BITO again in late February, rolling our puts out several times to collect more income as the price of Bitcoin ripped higher. When we exited the trade in early April, we pocketed $405 in cash, making it our second-largest profit from a single Options Income Weekly position so far in 2024 – after a longer-term put trade on Occidental Petroleum (OXY) that netted us $464.

When we entered our latest trade, BITO was around $26. Specifically, we sold the BITO 21 Jun 23 Put for around $0.38, or $38 per contract. Given the low capital commitment of just $2,300 per contract, we sold four contracts in the live account. This brought our total capital commitment to $9,200 and our cash in hand to $152.

That expiration was 31 days out, but we didn’t expect to be in the trade that long. We set a target exit price at $0.10, setting a good ‘til canceled (GTC) order to buy back the put at that level.

Unlike when we traded BITO earlier in the year (first two red arrows in the chart below), the ETF did not move significantly higher. Instead, it traded in a tight range between $26 and $28.

Yet, it remained comfortably above our put strike at $23. Our GTC was triggered on Friday morning, and we booked $28 per contract, or $112 for four contracts.

In short, our outside-the-box thinking in our pursuit of premium paid off, and we booked a 1.2% return in 17 days despite BITO remaining relatively flat.

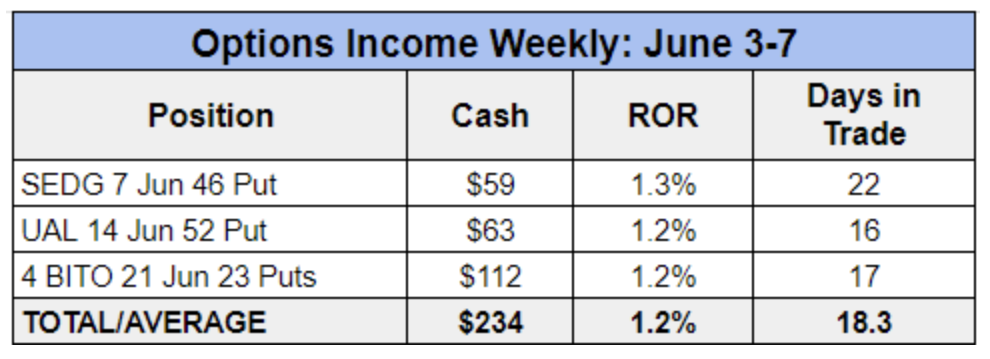

Finally, for those interested, here’s a look at all of our Options Income Weekly closeouts from last week:

As we continue our hunt for premium this month, we remain open to alternative opportunities like BITO in addition to some of our go-to names.