While a solid understanding of options and a focus on favorable conditions are crucial for generating income through options selling, there’s something undeniably appealing about a stock with a compelling narrative. In the case of Advanced Auto Parts (AAP), this story intertwines with a major pandemic trend, a surprising underdog and the potential for significant income generation through options.

The COVID-19 pandemic threw a wrench into the global supply chain, leading to a chip shortage that crippled new car production. This, in turn, triggered a surge in demand for used cars. As a consequence, the average age of vehicles on the road climbed, making automotive aftermarket parts retailers – companies like AAP – clear winners.

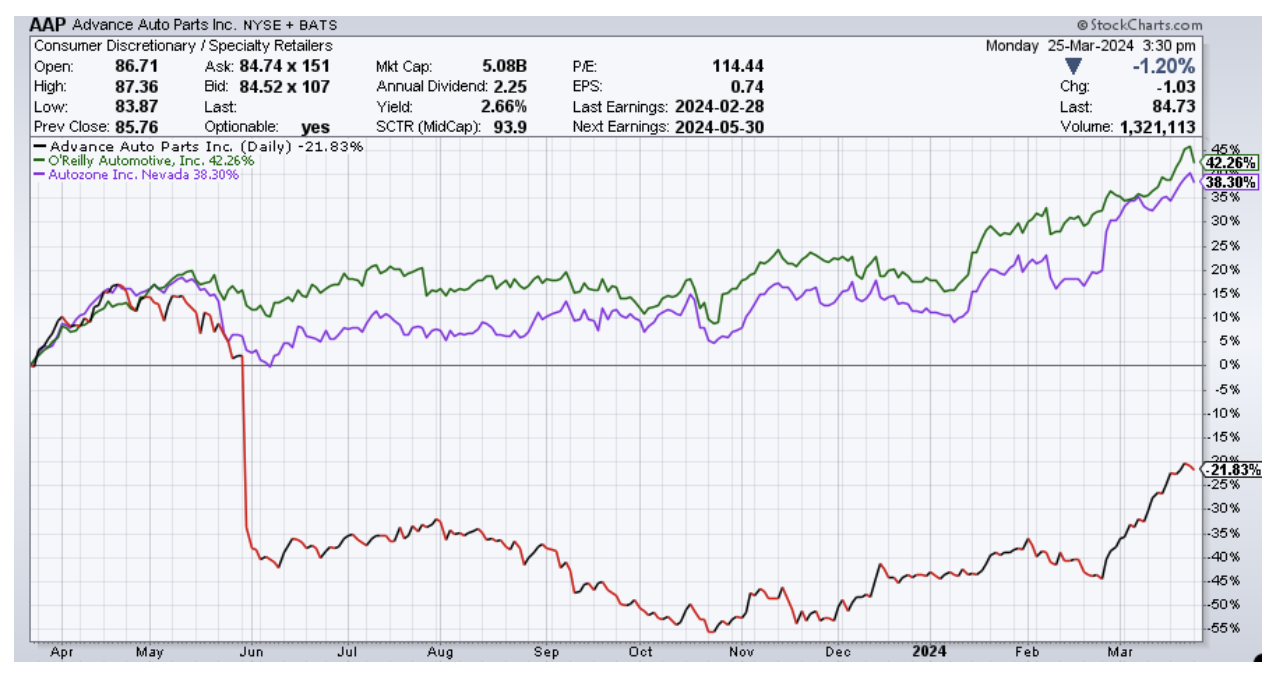

Investor enthusiasm for auto parts retailers initially remained strong even as the world began to emerge from the pandemic’s grip. However, a closer look revealed a clear divergence between the industry’s big three: AAP, O’Reilly Automotive (ORLY) and AutoZone (AZO).

When compared to its peers, AAP lagged significantly in terms of revenue growth, earnings performance and profit margins. This disparity was reflected in the stock price, with AAP’s one-year chart showing a clear underperformance relative to its competitors.

Things took a turn for the worse in May 2023 following a disappointing earnings report. The company not only missed analyst expectations for revenue and earnings, but also offered weak guidance and slashed its dividend payout. This resulted in a brutal 35% single-day drop for the stock.

AAP’s price continued to slide in the following months. However, over the past six months, AAP has defied expectations, emerging as the undisputed champion of the auto parts sector with a staggering share price increase of over 50%.

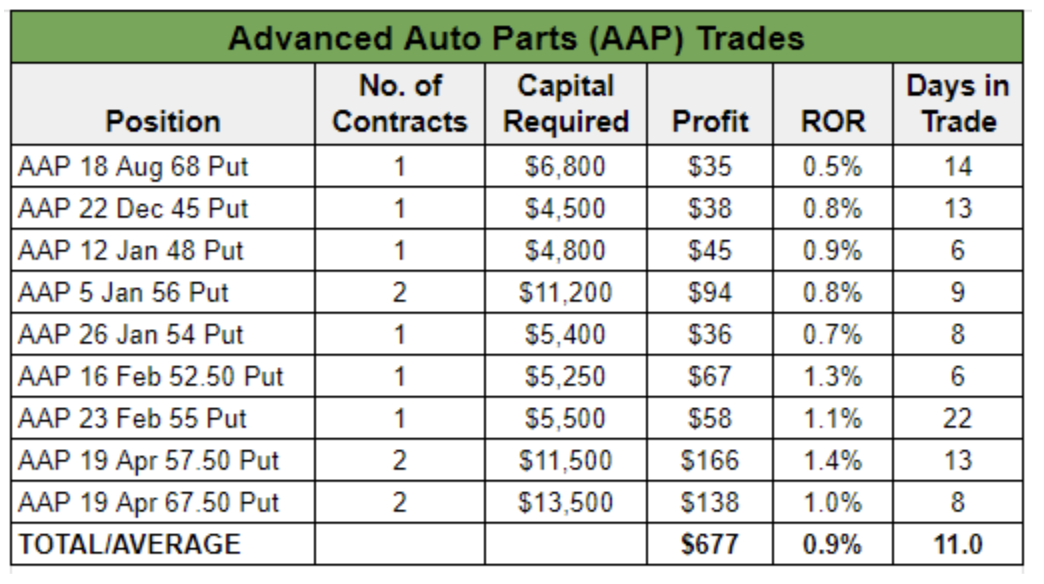

This dramatic turnaround presented a golden opportunity for options sellers like us. Recognizing the oversold sentiment and elevated option premiums following the disastrous earnings report, we began strategically selling cash-secured puts on AAP in the Income Masters program.

This approach has proven highly successful. We’ve executed nine separate trades on AAP since then, generating $667 in income.

Our initial strategy relied on cash-secured puts, a relatively conservative approach, and we averaged a 0.9% return per trade. However, with AAP’s price steadily climbing towards the $100 mark, we may consider transitioning to a bull put spread strategy. This strategy has the potential to significantly boost our returns while still bringing in an attractive amount of income.

Regardless of the specific options strategy employed, AAP’s remarkable turnaround story and its current price point make it a stock that deserves serious consideration for any income-oriented options traders. The tale of AAP serves as a reminder that even within struggling sectors, there can be hidden gems waiting to be unearthed, offering the potential for substantial profits through options trading.