The Coiled Spring Is Ready To Pop

The next few days are crucial for the markets, and your portfolios. The market wants to see a rate cut over the summer, but I don’t think they’ll get what they want, and that could lead to a bumpy ride ahead. Let’s break down what you need to know.

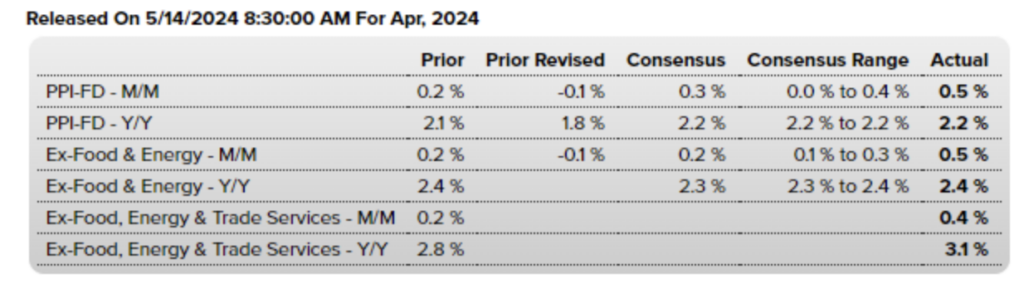

We saw the Producer Price Index (PPI) numbers come out on Tuesday, much hotter than expected. Month-over-month numbers were nearly double the consensus and the prior month.

The numbers don’t look bad for “Core PPI,” the group that excludes the two most volatile segments – food and energy. That group came in at a 2.4% increase year-over-year, but even that was higher than the consensus of 2.3%.

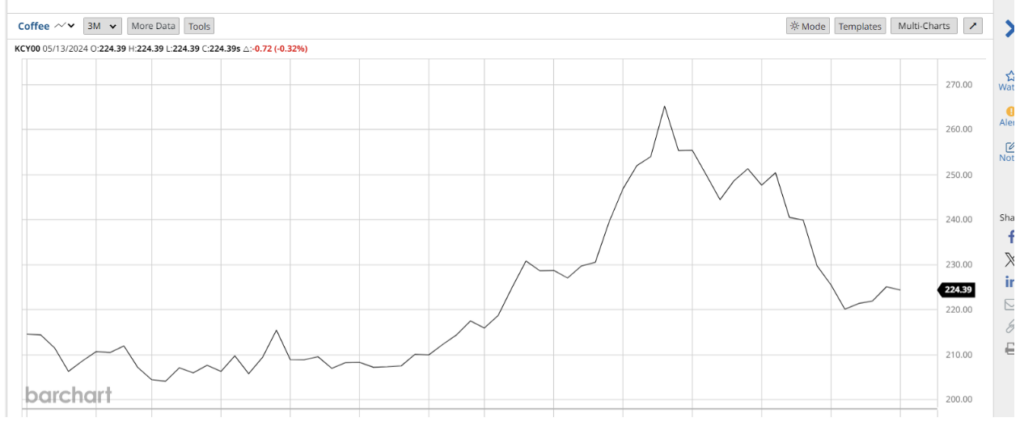

But, why should we exclude the cost of food? Just look at the cost of a cup of coffee lately. Here’s a chart of the Coffee commodity and from the end of March through mid-April it had a 23% run higher, before finally retracing. The higher cost of the coffee bean means the higher cost of your cup of joe before trading.

That helped put a damper on Starbucks’ (SBUX) parade. The stock has been falling since mid-November 2023 and got crushed during its last earnings announcement. Why? Due to the rising cost of food prices and their prediction of future sales.

Anyway, I digress. The “core PPI” may have gone up as expected, but the pain for consumers is far greater than what the report is showing.

In light of the PPI news, Fed Chair Powell spoke later in the day and said, “We’re being patient and letting restrictive monetary policy do its work.”

The labor market’s resilience persists, yet inflation, whether fueled by corporate greed with companies reluctant to reduce prices or spurred by other factors, lingers.

We’re in a game of chicken to see who or what breaks first. That’s not the best when the market is fundamentally overpriced compared to historical averages.

Why are the next few days so crucial?

We have a Consumer Price Index report along with Retail Sales. We’re not likely to see the results that are needed for a summer rate cut from the Fed, at least not if the PPI report foreshadowed anything. Those two reports can reinforce that inflation is back on the rise.

The other item to watch is the price action of the S&P 500. We had a controlled 5%+ retracement during April, which consisted of a higher low (HL), but so far we’ve yet to make a new higher high (HH) on the chart below.

What if that means we’re in a pattern that is setting up for a new lower low instead? Something like this:

A revisit down to 5000 would be roughly a 4.5% drop from current levels. Maybe it won’t be that bad, but a 2% drop from current levels would get us to around 5145 (using S&P 500 futures).

Can we go higher from here instead? Of course. Nvidia (NVDA) could come out with another blockbuster earnings report. Jobless claims could continue to rise. Maybe CPI and Retail sales drop but not too much.

I would want to see a breakout of this S&P 500 wedge to the higher side before loading up on too many bullish positions.