GOAL OF THIS CASE STUDY: To equip options traders with a comprehensive understanding of how to manage challenged trades, assess risk metrics, and apply practical strategies for defensive adjustments. This piece aims to build your confidence and control in navigating the unpredictable world of options.

WHO THIS IS IDEAL FOR: Options traders with a basic understanding of calls and puts who want to sharpen their risk management skills, especially if you:

Actively sell options (like covered calls, cash-secured puts, or credit spreads).

Want to learn how to defend positions that move against you.

Are ready to turn potential losses into strategic wins.

Your Trade Just Went South? Here's How We Pulled a Costco Comeback!

Let’s be real. In options trading, things don’t always go exactly as planned. You make a brilliant call, set up a perfect trade, and then… bam. The market decides to throw a wrench in your meticulously crafted machine. Sound familiar?

Most traders, especially newer ones, might hit the panic button. But the seasoned pros? They’ve got a secret weapon: defensive adjustments. This isn’t just theory; it’s the real-deal, gritty truth of how we wrangled a seriously challenged Costco Iron Condor and dragged it across the finish line… in profit.

Ready for a no-holds-barred look at how we turned a potential disaster into a win? Let’s dive in!

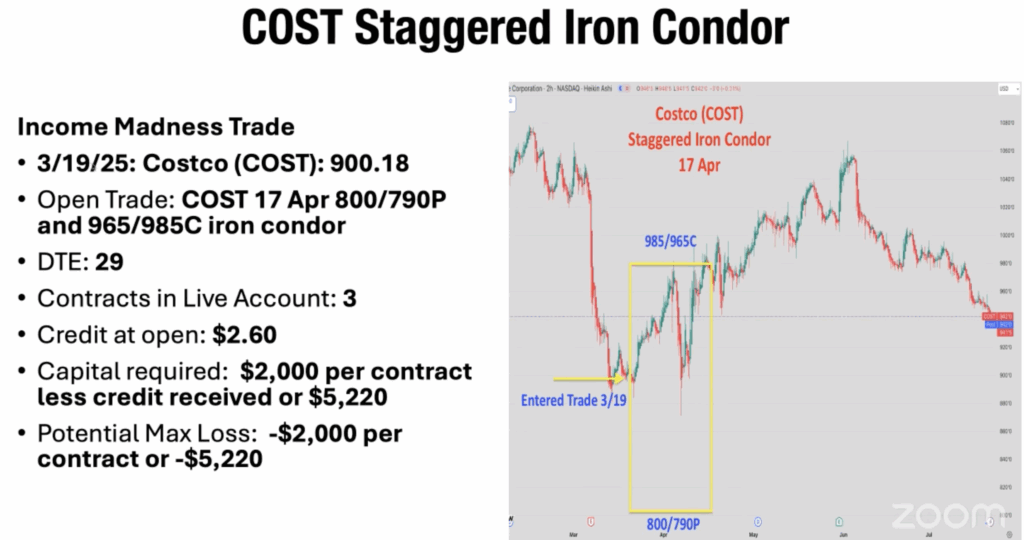

The Setup: When Costco Decided to Do Its Own Thing

Picture this: It’s March 19th, Costco is chilling around $900. We’re feeling good, setting up a staggered Iron Condor. Our brilliant logic? Costco looks a little pricy, history says it tends to dip, so we’ll lean a bit bearish. More room on the downside, less on the upside. We bagged a sweet $2.66 credit per contract right out of the gate. Easy money, right?

Wrong. So, so wrong.

Costco, apparently, didn’t get the memo about our downside bias. Instead of a graceful dip, it decided to do its best impression of a rocket ship. That’s the market for you – a humbling reminder that sometimes, your genius analysis is simply not what the stock has in mind. And that, dear trader, is when the real work begins.

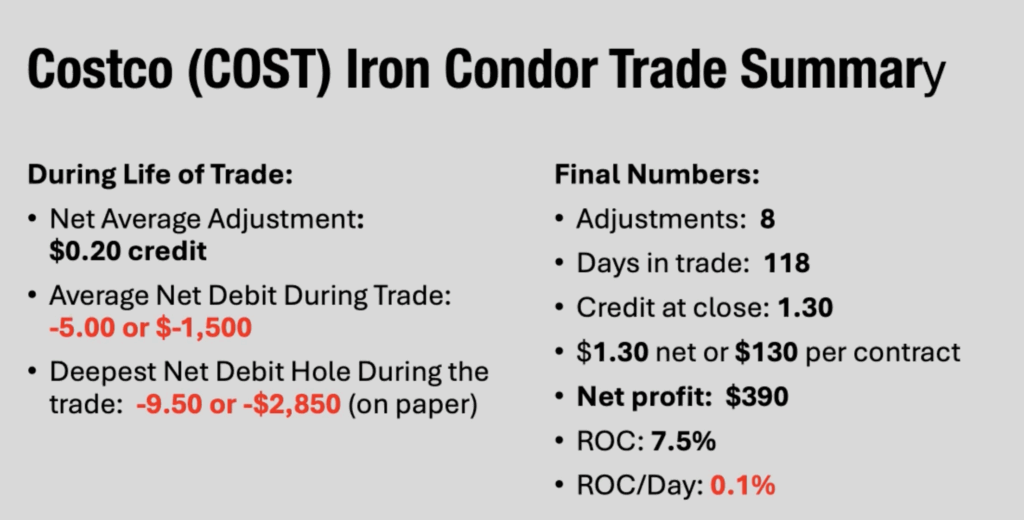

The Eight-Round Boxing Match: How We Adjusted, Rolled, and Fought Back

Over a marathon 118 days, this Costco trade became less of a gentle stroll and more of an intense boxing match. We threw eight key “punches” in the form of adjustments to keep it in the ring. Think of it as a strategic dance, where every step was designed to gain an inch, buy some time, and eventually, land that knockout blow for profit.

Here’s the blow-by-blow:

April 1st: The First Dodge (Rolling Puts Up) Costco’s climbing. We can’t let our puts get too cozy. We rolled them from 870/890 up to 830/820, pocketing a quick $0.45 credit. First move, keep ’em guessing.

April 10th: Buying More Time (Rolling the Whole Condor Out) The rocket kept soaring. We had to shift the entire condor from April 17th to May 2nd. Even as we moved, we squeezed out a tiny credit. Every cent counts when you’re in a dogfight!

April 16th: The Painful, But Necessary, Jab (Short-Term Roll & Debit) Sometimes, you gotta pay to play. We rolled to May 9th and, yep, took a small debit. It stung, but it bought us precious time and avoided immediate assignment. Think of it as an investment in survival.

April 30th: Catching a Breath (Rolling Out & Puts Up Again) More time, more put adjustments. Rolled out to May 23rd, pulling those puts up to match the stock’s climb. Another credit landed, helping offset that last debit. We’re gaining ground!

May 14th: Defensive Maneuver (Rolling Calls Up) Costco was still flirting with our call spread. To keep from getting “assigned” (which is rarely fun), we pushed our calls higher within the same May 23rd expiration. This was a $1.95 debit, but peace of mind? Priceless.

May 18th: The Gut Punch (The Toughest Roll & Biggest Debit) This was it. Costco went on a massive surge. We had to go aggressive: puts rocketed to 955, calls jumped to 1050/1070. The cost? A whopping $5.83 net debit. We were deep in the red on paper, looking like we’d fallen into a black hole. This is where most folks panic and bail. We held.

June 12th: The Turning Point (Collecting Credit as Stock Settles) Finally! Costco decided to take a nap. It settled into a calmer range. This was our chance! We executed a roll that snagged a sweet $2.80 credit. Suddenly, that massive hole looked a lot less intimidating. We were nearly back to square one.

June 26th: The Final Push (Another Credit Collection) With Costco behaving, we made our last adjustment: pulling the puts down a bit and rolling calls back down. Another $2.50 credit in the bank. The path to profit was clear.

The Payoff: From Gut-Wrenching to Green

On July 15th, after 118 days of sweating, strategizing, and a whole lot of rolling, we exited the Costco Iron Condor. Remember that deep, dark hole of $2,800 paper loss? We closed it out with a $1.30 profit per contract, for a total of $390 net profit in our live account. Not bad for a trade that wanted to send us to an early retirement (of the unwilling variety). That’s a 7.5% return salvaged from the jaws of defeat!

Pro Tips from the Trenches: Lessons for Your Trades

This isn’t just a war story; it’s a playbook. Here’s what we learned, and what you need to know:

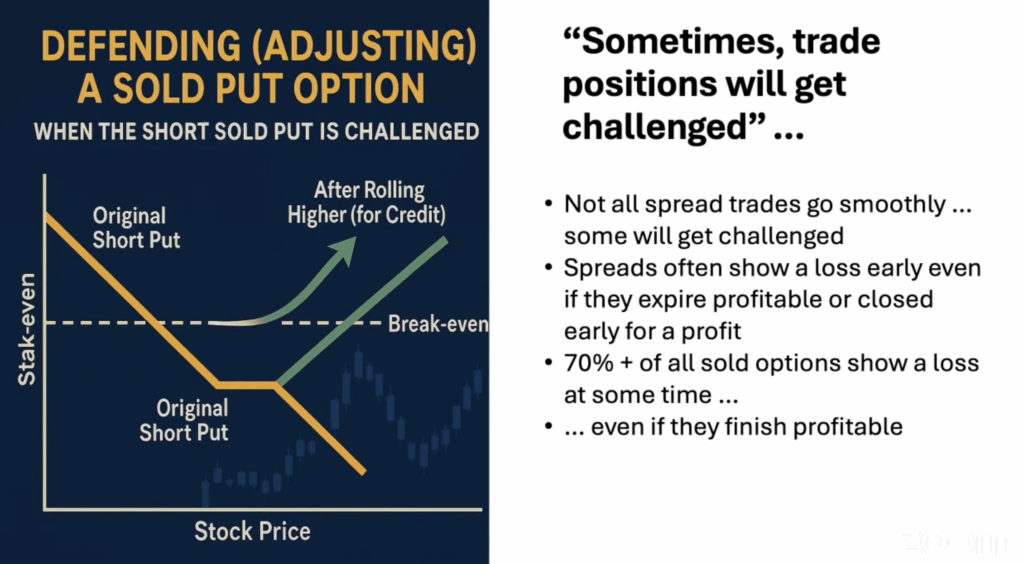

Your Trades WILL Get Challenged. Deal with It. It’s not a question of “if,” but “when.” Embrace the chaos, because that’s where the real money is made (or saved!).

Become an Adjustment Artist. Rolling, adding spreads, resetting – these aren’t just fancy terms. They’re your rescue tools. Learn them, master them.

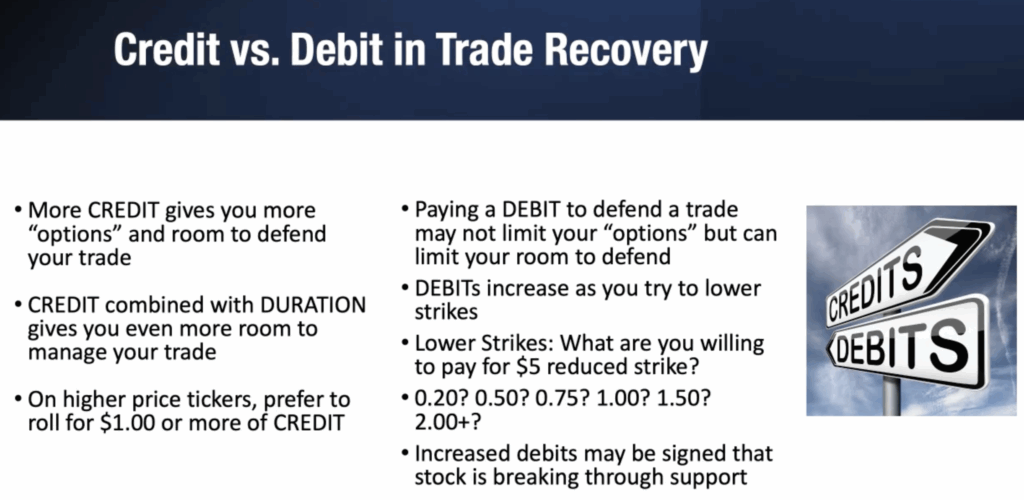

Credits Are Your Best Friend (Mostly). Always aim to collect credit when you adjust. It’s like putting money back in your pocket. But don’t be a hero; sometimes, a small debit now saves a huge loss later.

Your Broker’s Screen Lies (Kinda). That flashing P&L on your screen? It’s a snapshot, not the whole movie. You must track your net debits and credits across all adjustments to know your true position. That’s the real score.

Patience is the Ultimate Superpower. Panic selling at the bottom is how you turn paper losses into real ones. Stick to your plan, trust your adjustments, and give the market time to breathe.

Know When to Say “When.” Not every trade can be recovered. Sometimes, the best move is to cut your losses, even a small one. Remember Humana? We bailed with a tiny $0.57 loss rather than ride it into the ground and tie up capital indefinitely. It’s about preserving capital for the next, better opportunity.

Cash is King for the Next Round. Don’t marry your trades. Getting out, even after a long fight, frees up capital to jump into fresh, high-probability setups. We aim for under 90 days for a reason!

Broader Application: Other Trade Recovery Examples

The principles applied to the Costco trade are universal. We’ve seen similar successful recoveries across various stocks:

Micron: Adjusted multiple times due to market sell-offs and tariff risks, ultimately finishing with a $0.45 profit.

MicroStrategy (MSTR): Managed through three adjustments to achieve a $1.35 profit.

Nvidia: Recovered over 60 days to yield a $0.45 profit.

Netflix: A particularly successful recovery that resulted in nearly $1,500 in profit.

These examples, along with past experiences with other Costco put spreads, reinforce the effectiveness of disciplined trade management. While not every trade will be a winner, the goal is to manage positions to minimize losses and maximize winning opportunities.

The Battle Continues: What We’re Watching Now

The trading game never stops. Right now, we’re deep in the trenches with our “four sisters” – Constellation Energy, Salesforce, Lululemon, and Vertiv Holdings. These positions were all impacted by market reactions earlier in the year, particularly the tariff discussions in March and April.

Good news: Vertiv Holdings is nearing profitability, potentially just one more roll away, and we’re so confident, it’s slated to be our next in-depth case study! Constellation Energy is also clawing its way back. Salesforce and Lululemon are tougher nuts, but we’re working to get them to a point where we can exit with a small, strategic loss.

The takeaway? Trade positions will inevitably be challenged. It’s a fact of life in the markets. But with the right mindset, the right tools (those defensive adjustments!), and a healthy dose of patience, you can navigate those storms, recover from deep drawdowns, and keep your portfolio moving in the right direction. It’s about smart trading, not just lucky trades.

Watch The Full Case Study Here:

YOUR NEXT RECOMMENDED TRAINING: