MORE PUT LADDER RESULTS

August 17, 2023

With all major support lines breached, 50-day moving averages failing, and no positive economic news on the horizon, the market continues to sink lower. When this happened in February of this year, the S&P 500 saw a 9% dip over six weeks (from peak to trough). If this is another pullback like that, you still have time to hedge your portfolio against a potential 5% further slide. That makes it a good time to review what John Hutchinson wrote about a few weeks ago with his laddered bear put diagonal spreads.

Here’s a quick review of the put diagonal spreads John wrote about, using the S&P 500 ETF, SPY.

The total cost for this put ladder would have been $628 and the total profit was $1297, or about 206%!

Now, before you write in, I know some of the strike prices step on each other, so the only way you could have mimicked these results would be to trade in separate accounts.

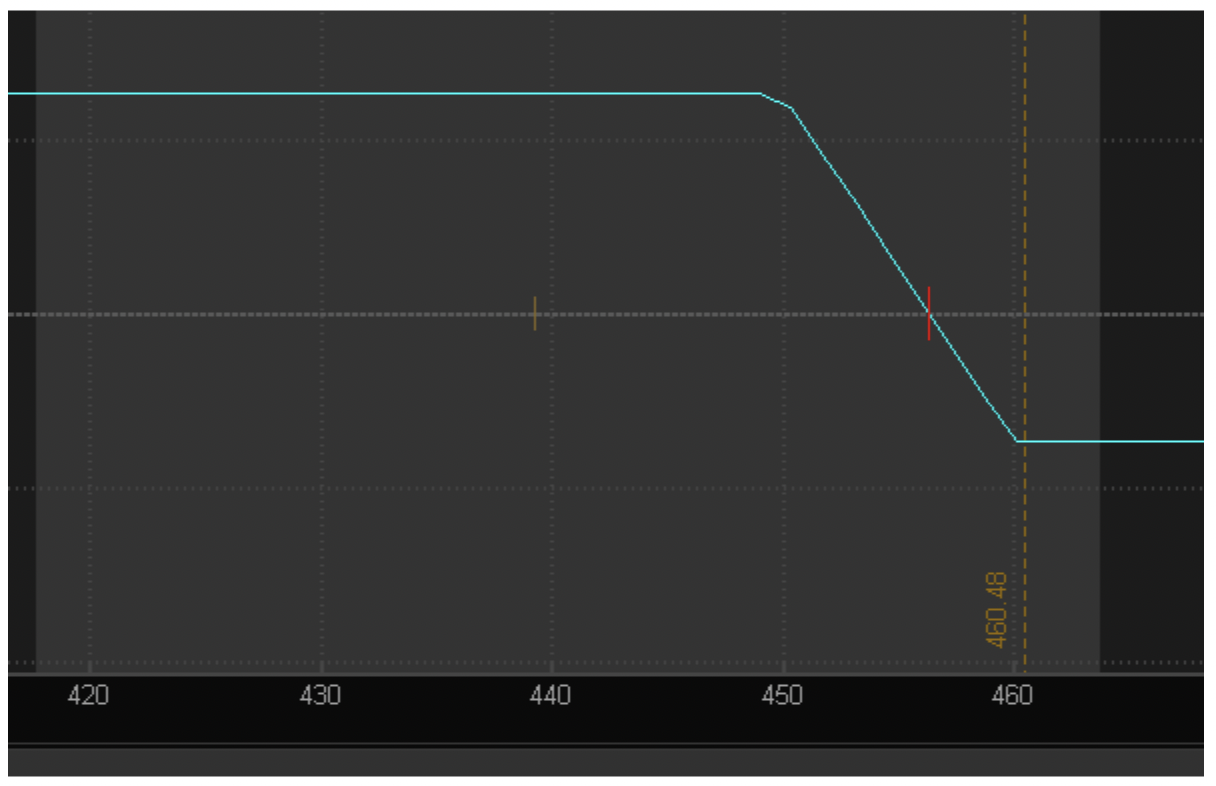

To some, it seemed outlandish to talk about puts when the market looked like this:

But the next day the SPY hit a high of $459.44 and that’s right around the time John went in for the bearish put spreads.

First, he looked at options that expired about a month away, so he started looking at the 25-AUG expiration. Next, he looked at two strikes in the money, which at the time, was $460. On the chart I posted earlier, John looked at the green, dashed line as an area of potential support. That gave him the area where we wanted his first two rungs to end.

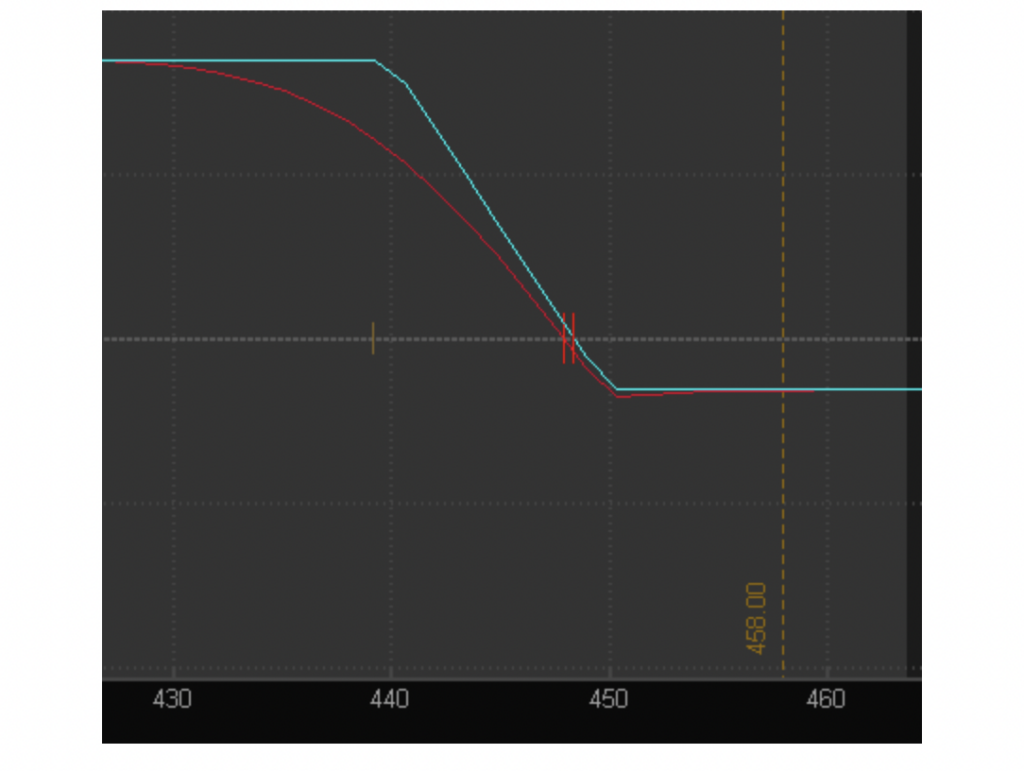

He had his entry in mind – somewhere around $460 and his target of $440. He then wanted to create two rungs that split evenly between entry and target, so that meant creating two positions, each as a $10 wide debit spread.

Rung 1 was complete with the 25-AUG 460/450 bear put debit spread.

Rung 2 was complete with the 25-AUG 450/440 bear put debit spread.

It’s important to note that debit spreads are affected negatively by time risk, aka theta decay. This means that for every day that goes by, your options decay in price unless the underlying has a strong move in the correct direction. In this case, we did get that big move John was looking for.

Rung two, while a much cheaper trade to buy, was further away from being in-the-money, which means it had a smaller probability of making money. However, John timed the trade perfectly.

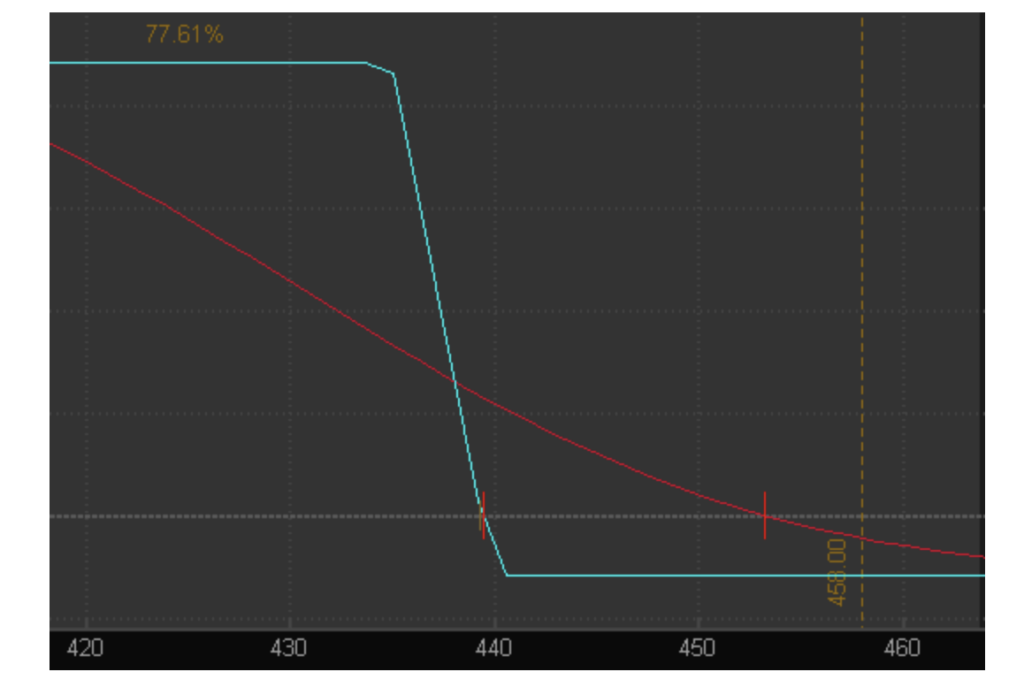

Now, for the next ladder rung, he went out about 20 days, which was also the next monthly expiration. You can certainly look out for another 20-30 days.

Rung 3 was the 15-SEP 440/435 put debit spread. You’ll notice this was much further out of the money, so the trade was even cheaper and offered a sizable reward-to-risk ratio, but it had a smaller probability of max profit.

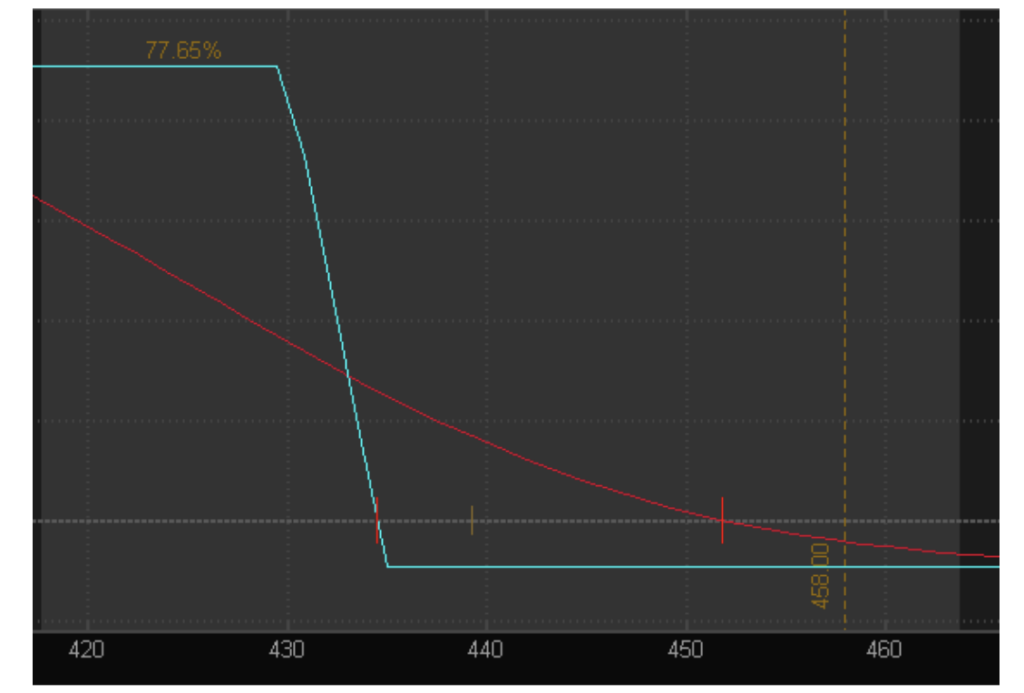

And Rung 4 was created using 15 SEP 435/430 put debit spread.

You may have noticed, the last rung is not yet in the money, but the move was substantial enough in a short time for this trade to become profitable.

You may have also noticed that Rungs 1 and 2 were $10 wide and Rungs 3 and 4 were $5 wide.

So, why go $5 wide for the last two rungs?

Selling a put closer to the purchased put reduced the cost of the trade, and yes, it did limit the upside return.

But let’s take a deeper look at the options.

15-SEP 440 / 430 put debit spread was trading for 1.01

15-SEP 440 / 435 put debit spread was trading for 0.59

Remember, John was looking at support around the $440 level. Having the gift of hindsight, we know that SPY eventually reached $440. So how did each of those options do?

The $10 wide spread had a higher potential reward, but with SPY trading at $440, the spread increased in value to $2.93

With SPY trading at $440, the $ 5 wide spread increased in value to $1.74.

Ok, $2.93 – 1.01 = $1.92, which is higher than 1.74 – 0.59 = $1.15, right?

Yes, $192 is greater than $115, but the $10 wide spread was a 190% return (1.92/1.01), while the $5 wide spread was a 195% return (1.15/0.59).

Ok, 5% may not seem like a lot, but that adds up over time, and given where the market was at the time, it seemed a bit far-fetched that we’d hit $440 in a short period of time. Had the market fallen a little slower, the $10 wide spread would have decayed, which would have shown an even better result for the $5 wide spread in this comparison.

If SPY drops to $430, then sure, the $10 wide spread would have been better, but remember that this is a hedge trade. We’re not shooting for the moon with this idea. We’re trying to use a small percentage of free cash to protect a larger drawdown.

Now, if you’ve made it this far and want to go through this whole process again, we will be spending some time with these articles, showing how you can set up a new ladder (one where we don’t step on strikes) and with more current data. Keep on the lookout next week!

Have a great weekend!

If you have any questions, comments, or anything we can help with, reach us at any time.

Email: [email protected]

Phone: (866) 257-3008

Jeff Wood

Editor, Filthy Rich Dirt Poor

Coach, Options Testing Lab

Any trade or trade idea discussed is for educational purposes only. They will not be tracked as an official trade recommendation.