We recently wrapped up another exciting round of Income Madness! During six straight days of live trading, we executed a mix of cash-secured puts and spread trades, generating a healthy stream of income.

While our usual goal is to quickly capture profits and redeploy capital, this time around we faced a unique set of challenges.

First, across all our services, we’ve observed trades taking longer to reach target exit prices. This coincides with the broader market’s April slump, with the S&P 500 down roughly 3% for the month.

But we must trade what the market gives us, and we adapted our strategy accordingly. We adjusted expiration dates, strike prices and target exits to account for the increased market risk.

The second challenge — and potential opportunity — came in the form of earnings season. Earnings announcements can fuel volatility, offering juicy premiums for options sellers, but also introduce significant risk. Because even if a company beats analysts’ estimates and offers positive guidance, there is no telling which way the stock will move.

The best thing we can do is pay attention to expected moves and carefully pick our trades. Often this means avoiding trading a stock just ahead of its earnings announcement, but there are exceptions.

For instance, we entered an Income Madness trade in Vertiv Holdings (VRT) on April 23, the day before the data-center systems specialist was set to report earnings.

The stock had been in a solid uptrend all year, as you can see in the chart below:

But we acknowledged the higher risk related to the earnings announcement, noting that anyone who was uncomfortable with it could simply take a pass on the trade.

For those who were game, we took the following steps to put the odds in our favor:

- We liked the fundamentals of the company and believed it was likely to deliver a positive earnings report.

- We went out to the May 17 expiration, giving us 24 days to manage the trade.

- We went with a short strike with a 13 delta that was more than 15% out of the money and well below the expected one-day post-earnings move.

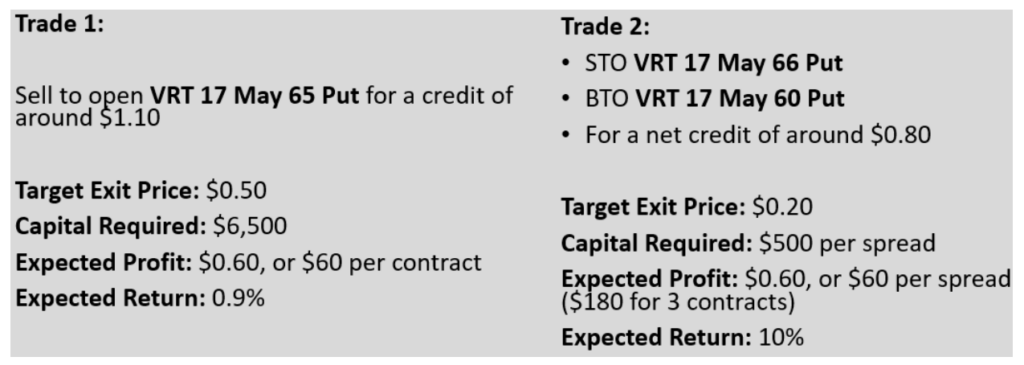

For this trade, we recommended both a cash-secured put and a bull put spread, allowing traders to choose the one that best suited their cash goals and portfolio size.

Vertiv reported better-than-expected earnings before the market open on April 24. Earnings per share were up 79% year over year to $0.43, while revenue rose 8% to $1.64 billion. Management also raised its full-year earnings guidance.

Shares shot up as much as 19% following the announcement, hitting a new all-time high.

Both our cash-secured put and bull put spread hit their target exit prices in less than 24 hours. We booked 55% of the max profit and a 0.9% return on the cash-secured put and a 10% return on the spread position

This is the kind of trade we love in Income Madness.

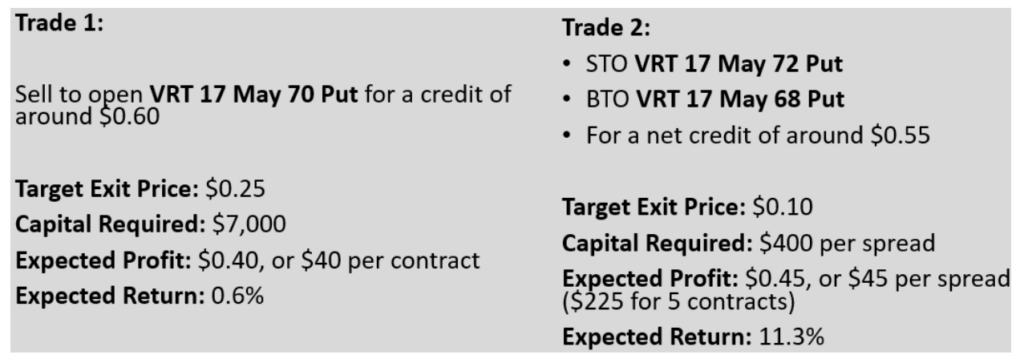

And we didn’t stop there. We re-entered VRT that same afternoon, taking advantage of the post-earnings rally. We maintained the May 17 expiration but used higher strikes to reflect the increased stock price.

Our focus remained on conservative exits, aiming to hold the trade for five to seven days. However, VRT continued its upward climb, triggering our good ‘til canceled (GTC) order to exit the cash-secured put the next day. We captured over 60% of the maximum profit and a 0.6% return — again, in less than 24 hours.

The VRT spread was about a nickel above our target exit price, but we decided to close it anyway, locking in a 10% return on our capital.

Our final VRT play targeted a May 24 expiration. While it hasn’t reached its target yet, the stock remains on an upward trajectory, putting us on track for a profitable exit well ahead of expiration.

These VRT trades illustrate how option sellers can leverage short-term volatility around earnings announcements while managing risk. By carefully analyzing fundamentals, using appropriate expiration dates and strike prices, and implementing targeted exits, we were able to capitalize on this opportunity and generate significant returns for our Income Madness participants.