Some brokers out there allow you to build your portfolio based on an amount rather than a specific number of shares. This is done through fractional share purchases and I bring this up because it has now allowed me to think about building a dividend portfolio in a new way.

I no longer have to buy full shares of companies with my IRA contribution. Now, I can build a portfolio of companies, with as little as about $500 to get started.

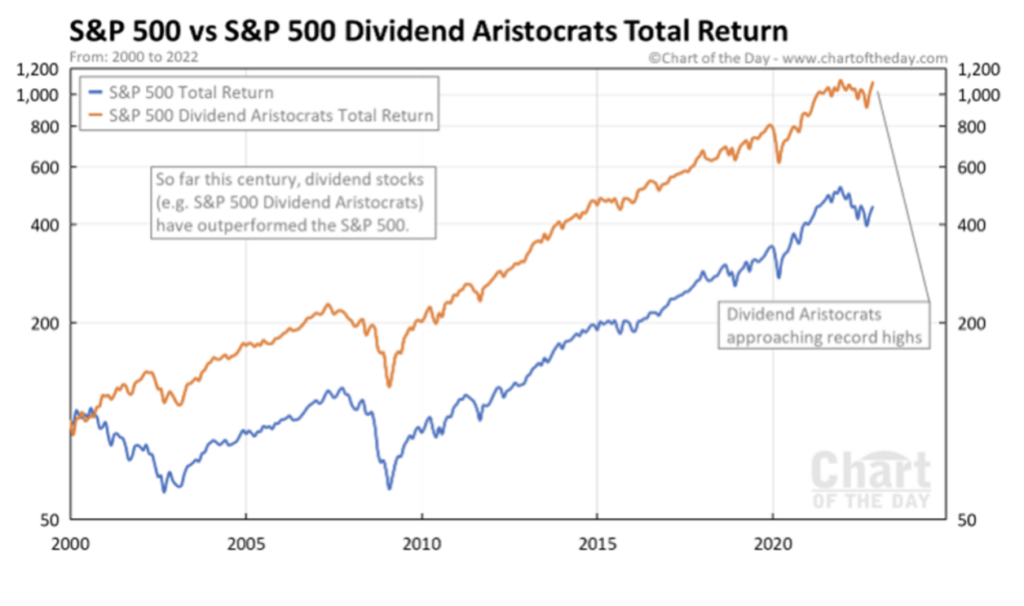

I started my dividend journey by looking at the dividend aristocrats. It’s a great start for those looking to build a dividend portfolio.

But then I started thinking about the stocks that not everyone is thinking about.

KeyCorp (KEY) is a holding company that provides a range of retail and commercial banking, commercial leasing, investment management, consumer finance, student loan refinancing, commercial mortgage servicing, special servicing, and investment banking products and services to individual, corporate, and institutional clients.

It has an estimated dividend of 5.36%, sales growth of over 28%, a forward P/E of 9.33 versus a current P/E of 17.35, meaning it’s trading at a discount rate to forward earnings, and a short float of 2.86%.

The dividend is nice, but I’m also looking for stocks in an upward trend channel to potentially get appreciation on the underlying as well as dividend premium.

Next up on the list is NetApp (NTAP). It is a data management and storage solutions company with a respectable 1.88% dividend yield. Netapp has not only been able to offer its investors consistent dividends for over a decade but has also managed to increase its dividend every year since 2014.

The company has been able to raise revenues by 22.10% per year, outperforming over 60% of companies operating in comparable industries. It has a similar situation with a short float under 5%, forward P/E less than current P/E, increasing earnings-per-share each year, and sales growth over the last three years.

The last stock is Iron Mountain (IRM). They provide supporting information storage and retrieval services for businesses that rely on paper documents or computer tapes to store their valuable information.

Much like the previous two, the stock is trading at a discount to forward earnings, has a short float of less than 5%, a history of increasing sales, and the underlying stock is trending in a nice lower-left to upper-right angle on a daily chart.

While these stocks may not have flashy 8-10% dividend yields, I like to find stocks that give me potential growth of the underlying as well as dividends.

And now that I can have a robo-advisor buy fractional shares every couple of weeks, I’m on my way to building up my dividend portfolio.