Despite the holiday-shortened week, we managed to net over $900 in profits across our services. Here are all the closed trades from the week of June 30 to July 3:

This past week also marked a significant transition: the conclusion of the Options Income Weekly program. For many of you, this service was your gateway into the dynamic world of selling options.

I’ve been personally involved with Options Income Weekly since joining Traders Reserve in 2017, working alongside Michael Shulman and later Dave Durham. During that time, I have witnessed countless successes, alongside the inevitable ups and downs inherent in trading.

Closing this chapter is bittersweet, as we know how much many of you valued the program. But we’ve also seen how far our members have come, watching your trading confidence and sophistication grow over the years.

Pivoting to Peak Performance: The Power of Credit Spreads

That trader evolution, as well as changing market conditions, has led to us prioritizing spread trading, which, as many of you know, is the core focus of the Income Masters program.

As I detailed in a recent Weekly Income Report (you can read the full article here if you’re interested), the advantages of credit spreads over cash-secured puts are compelling. They include:

- Lower capital requirement/superior leverage: Maximize your trading efficiency.

- Higher potential return on capital (ROC): Generate more profit from your deployed capital.

- Defined and limited risk: Gain peace of mind with known maximum loss.

The results speak for themselves. As you can see in the table above, four of our five Income Masters closeouts last week were spreads. These spread trades accounted for roughly 90% of the week’s income, returning an impressive average of 10.9% with an average holding time of less than two weeks.

Looking at 2025 year to date, our Income Masters spread trades have consistently averaged an 8% to 11% return, significantly outperforming our cash-secured put trades, which averaged 0.5% to 1.5%.

Reflecting on a Strong First Half

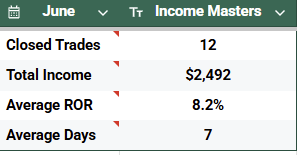

In the previous Weekly Income Report, we highlighted all of the trades we made in June since we launched the daily Income Masters channel.

It’s worth noting that the June total does not include trades opened prior to our daily channel launch on June 2. Factoring those in adds another $934, bringing our total cash booked for June to $3,426.

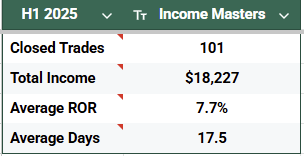

The first half of 2025 has been exceptionally strong for the Income Masters portfolio. We closed 101 trades, totaling over $18,000 in cash. And with five more wins already booked in July, we’ve surpassed the $19,000 mark.

While we are actively managing some sizeable net debits on recovery positions, particularly from April’s tariff-induced sell-off, our disciplined approach and patience has proven effective in mitigating capital losses in the past.

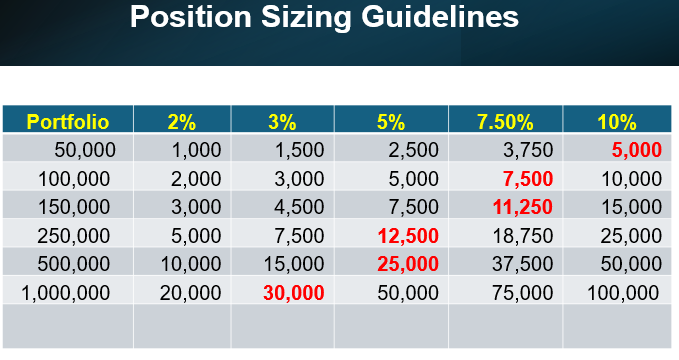

Key to this success is appropriate position sizing, a critical topic Dave covered in Wednesday’s deeper dive into trading tactics on the Income Masters channel. He emphasized sticking to maximum position size guidelines to avoid significant portfolio drawdowns.

Dave also shared the following visual to help members determine appropriate sizing based on portfolio value.

In summary, last week’s $1,001 in cash booked easily exceeded our $650 weekly goal for the Income Masters program, even with 1.5 fewer trading days due to the July 4th holiday. While we won’t beat our goal every week, weeks like this provide a robust cushion for leaner periods.

If you’re interested in learning more about how the Income Masters program can help you leverage the power of spread trading, go here.