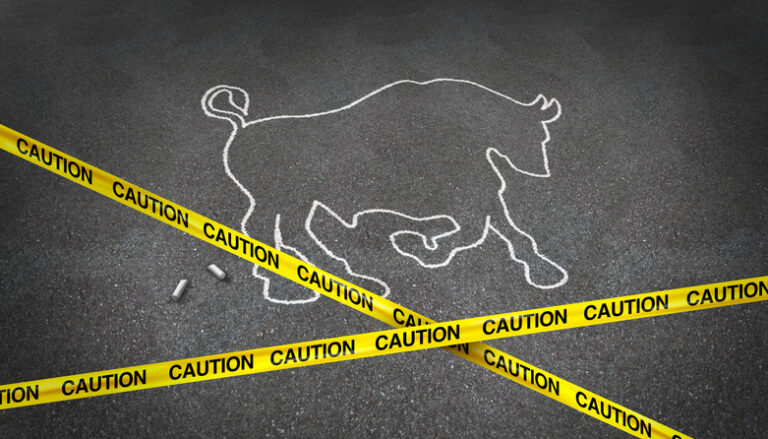

Bullish Rally in Trouble?

Emily Norris

Analysts have been warning that earnings season could pose a challenge to the bull run and that theory is about to be put to the test this week with some big tech earnings on deck.

While a number of U.S. banks beat Q2 revenue and profit expectations, due in part to higher interest rates, they also warned about potential risks going forward, including a slowdown in consumer spending.

So far, stocks have been resilient. The S&P 500 is up about 1% since the first of the big banks reported on July 14. However, big tech earnings may prove to be a bigger hurdle.

The Nasdaq was dragged down last week by post-earnings sell-offs in Tesla (TSLA) and Netflix (NFLX). The electric vehicle maker posted record quarterly revenue, but operating margin disappointed. And Netflix’s revenue came in below expectations despite adding 5.9 million subscribers thanks largely to its password-sharing crackdown.

Take a look at the chart below from Bloomberg, which helps illustrate why the next two weeks will be crucial.

The red region shows the return of the FAANG + MNT stocks accounted for 10.82% of the S&P 500’s gain during the first half of the year, while the blue region shows the other 492 stocks accounted for 2.88%.

And here is a look at when the FAANG + MNT stocks are slated to report earnings:

- Meta Platforms (META): July 26 after the close

- Apple (AAPL): Aug. 3 after the close

- Amazon (AMZN): Aug. 3 after the close

- Netflix (NFLX): Already reported

- Alphabet (GOOGL): July 25 after the close

- Microsoft (MSFT): July 25 after the close

- Nvidia (NVDA): Aug. 23 after the close

- Tesla (TSLA): Already reported

Three of the FAANG + MNT stocks — Meta Platforms, Alphabet and Microsoft — will report earnings today and tomorrow. And their results could move the market sharply in either direction in the short term.

Of course, those earnings reports aren’t the only thing traders must contend with this week. The Federal Reserve is meeting on Tuesday and Wednesday.

The Fed is widely expected to hike the fed funds rate another 25 basis points after taking a pause at its June meeting. But even if all goes as expected, I wouldn’t rule out a sell-the-news event, especially if big tech earnings put investors on edge.

Try to remain nimble this week. Take profits where you can and avoid taking any undue risks ahead of what is likely to be a volatile week for the markets.

Trade smart,

Emily Norris

Managing Editor

Traders Reserve

Contact

267 Kentlands Blvd #225

Gaithersburg, MD 20878

P. (866) 257-3008

(Monday-Friday 9:00 AM-5:00 PM EST)

About

Publisher of actionable and proven strategies and tactics to help investors build wealth and reach seven-figure portfolios.