Stocks ended February on a high note, with the S&P 500 up more than 5% for the month as investors took economic data in stride. And the Nasdaq Composite closed the month at a record high, its first since 2021.

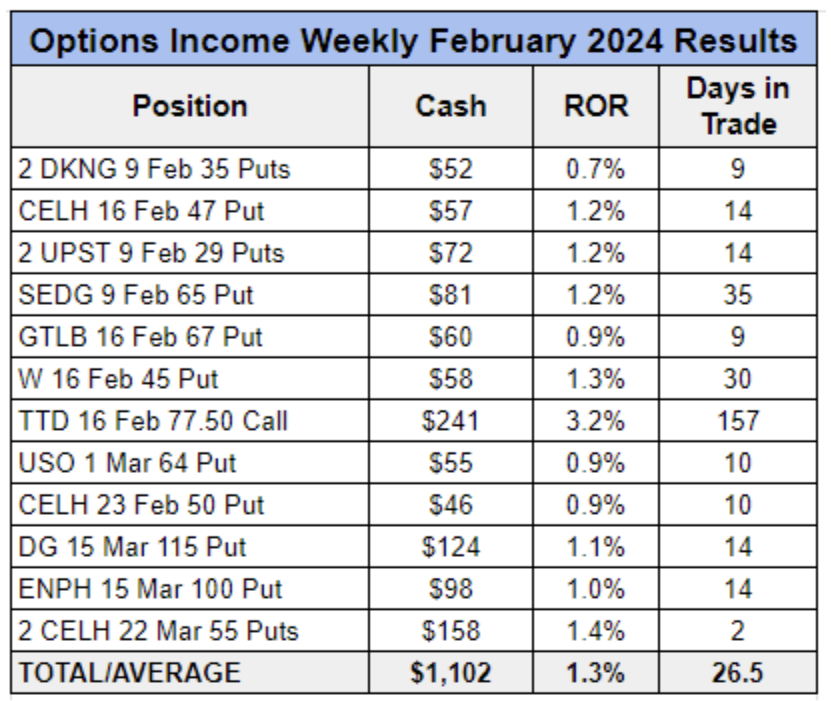

At Options Income Weekly, we doubled the number of closeouts to 12 from six the previous month. And we generated 2.5 times as much cash in our live account, pocketing $1,102 versus $444 in January.

Here’s a look at the all the trades we closed last month:

As you can see in the table above, we had success with a number of energy stocks last month as oil and gas traded higher, booking winners on United States Oil Fund (USO) and Enphase Energy (ENPH). And we’re making good progress on our Devon Energy (DVN) recovery trade. If energy stocks continue to rally, we’re likely to close that position out at a profit soon.

Speaking of recovery trades, our patience paid off on The Trade Desk (TTD). By staying calm and selling calls once we saw shares move higher for a few consecutive days, we managed walk away midmonth with a nice profit on a trade that had been deep underwater a month earlier. (You can read more about our TTD recovery trade here.)

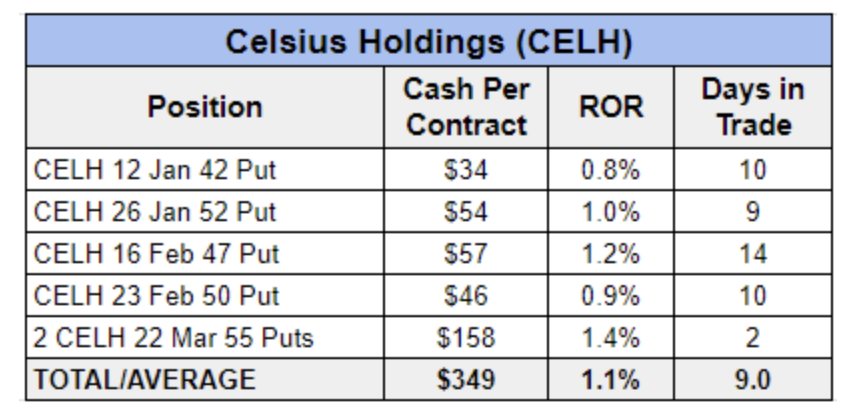

Next, with three profitable closeouts last month, Celsius Holdings (CELH) has emerged as our most traded stock of the year in Options Income Weekly.

We’ve booked four winning trades on the popular energy drink maker so far this year and five since we began trading it in September, averaging a 1.1% return per trade with an average holding time of nine days.

Our latest CELH trade was open for just two days and was an earnings play, which carries more risk than your typical trade.

During the Feb. 27 Live Trading Session, we noted that CELH had a high implied volatility rank (IVR) of 83% and a one-day expected move of 8.3% due to its upcoming report. Keep in mind that the expected move could be in either direction. And even though Celsius was expected to meet or beat estimates when it announced before the market open on Feb. 29, even a strong report didn’t guarantee that shares would move higher. Plenty of companies see their stock sell off after beating expectations.

But we wanted to take advantage of the high IVR and elevated option premiums by selling the CELH 22 Mar 55 Put for $1.04, or $104 per contract. We sold two contracts in our live account, generating $208 in cash. And we set a target exit price of $0.25, placing a good ‘til canceled (GTC) order to buy back the put at that level.

We chose the March 22 expiration to give ourselves time to manage the trade should CELH sell off after earnings, and the 55 strike was well below the expected move at 18% out of the money (OTM).

Still, we know some members are not comfortable holding a position through earnings, and we encouraged them to take a pass on the trade. But for those who were willing to take the risk, the trade paid off handsomely.

CELH rallied more than 10% Thursday morning following the company’s earnings report. Fourth-quarter earnings per share of $0.17 missed the consensus estimate by a penny, but investors seemed pleased with revenue growth, which was up 95% year over year to $347 million.

The post-earnings rally triggered our GTC order to buy back the put, and we booked a profit of $79 per contract, or $158 total for two contracts, for a 1.4% return in less than 48 hours.

As we look ahead to March, we expect the pace of trading to remain steady as we head into the final stretch of the fourth-quarter earnings season. While very few people are expecting the Federal Reserve to cut rates in March, we could see some additional volatility around the March 19-20 FOMC meeting as investors parse central bankers’ statements.

After witnessing the best two months to start a year for the Dow and S&P 500 since 2019, it’s hard to say whether stocks will stall or continue to climb. But we will continue to trade what the market gives us.