The entirety of the rally in the stock market since the end of October 2023 is based on the expectation that the Fed will cut rate multiple times in 2024. This week’s FOMC (Open Market Committee) meeting is the second of the year and will be closely watched for how the Fed expects to handle interest rates this year and next.

Minimum expectations: Fed reiterates expectation for 2 to 3 rate cuts in 2024, with the first cut occurring at the June FOMC meeting.

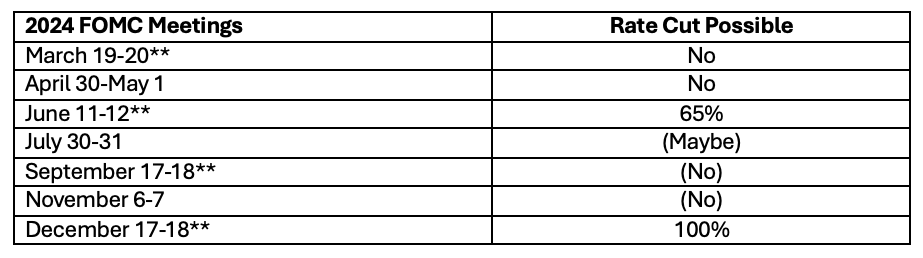

The problem: It may be March, but we’re already running out of dates for potential rate cuts this year.

No cuts are expected now at the March or April meetings. Potential for cuts at the June meeting have decreased by -35% (from 100% to 65%), which adds pressure to this week’s meeting: Will the Fed stay on track for a summer rate cut.

At this point, it doesn’t matter if the Fed cuts in June or July, but for the S&P and other indices to hold current valuations, a rate cut must occur in one of those months.

One concern for September and November is that the Fed will not take any action given the backdrop of a Presidential election in those two months to avoid ‘interfering’ with politics.

That leaves December and that means the original expectations for bullish investors that the Fed would cut rates 4-6 times in 2024 is both out the window and moved forward into 2025.

**Quarterly FOMC meetings where the Fed publishes its forward-looking interest rate expectations, or the “dot plot.”

What this means for stocks:

- If the Fed reiterates its recent commentary – all but guaranteeing a rate cut in June, despite inflation bouncing back in recent months – the current rally in the stock should resume.

- If the Fed casts doubt on a rate cut in June, we’re likely to see the short-term decline in stocks continue (back down to 4800 on the S&P 500).

Inflation, Growth, Fed, “Tulips”

The four cornerstones of the long bullish rally to new all-time highs in the S&P 500 are:

- That inflation will continue to decline.

- That earnings will continue to grow.

- That the Fed will cut rates “x” times in 2024; and,

- Tulips, or Artificial Intelligence, will act as the major growth accelerator.

Last week’s economic data damaged two of those four cornerstones: inflation and growth, as inflation bounced back and continues to prove sticky at 3%; while retail sales and corporate earnings commentary showed falling consumer activity and demand.

It doesn’t really matter how many times the Fed cuts rates this year. What matters is that very first rate cut (this is the policy shift from hawkish to dovish that Wall St. is waiting for).

Likewise, AI can only lift the market so far: not unlike 2017 when just 3 stocks accounted for the ‘gain’ in the S&P 500, Nvidia (NVDA) can only do so much to lift the markets to continued new highs.

I think we’ll see the April-May-June period more volatile and with more pressure to the downside unless inflation or growth metrics change.

The biggest influence – and key to watch: 10-Year U.S. Treasury Yield

The 2023 sell-off in the late summer, early fall period was driven by the sudden rise in the 10-year yield to more than 5%. Yields have risen again from lows of 3.75% to nearly 4.3%. If yields continue to rise, expect more pressure on stocks to the downside in the weeks ahead.