Volatility is near record-low levels, which is prompting us to add new tactics to our trading arsenal. Find out how Income Masters members locked in a 5.3% return on Microsoft (MSFT) — in just three days — by utilizing a neutral-to-bullish strategy that benefits from time decay.

They say that volatility is a double-edged sword, and that’s especially true for option sellers like us. While higher levels of volatility translate to increased risk of market losses, they also mean higher option premiums. Stocks’ steady grind higher in 2024 has option sellers in a bit of a jam.

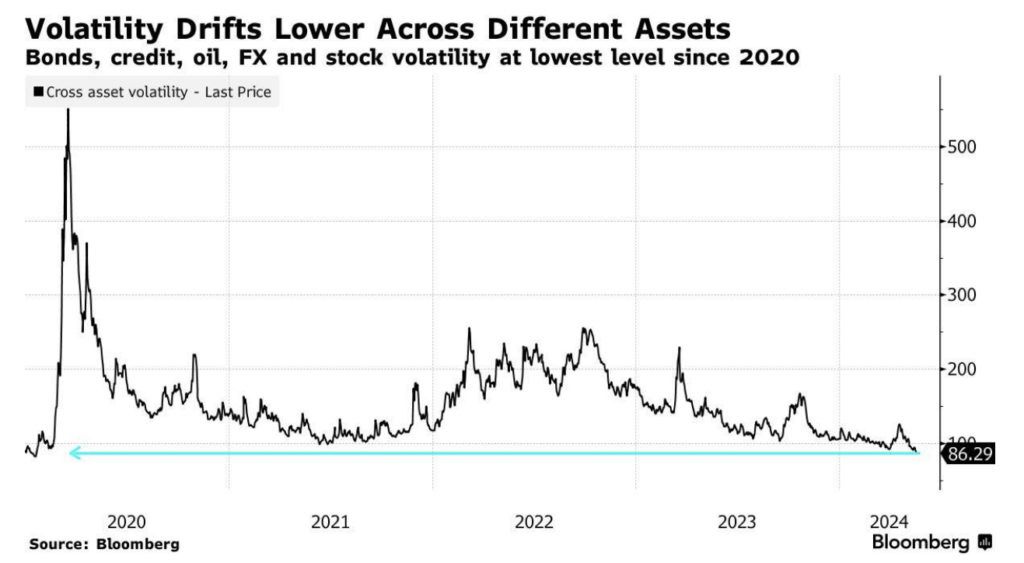

Last week, the VIX Index hit a low of 11.52. This was its lowest level in nearly five years and rivaled the record lows from 2017, which, according to Bloomberg, marked the least volatile stock market in modern history.

In that Bloomberg article, ominously titled, “Options Volatility Is Getting Crushed With Little Relief Ahead,” the author notes that the market’s relative calm – across all asset classes — is persisting in the face of ongoing economic risk.

“With stocks pushing to new highs and nothing seriously threatening the rally, there’s little incentive for investors to short the market,” writes Jan-Patrick Barnert. “Hedging demand is very low, with long put options positions failing to pay out in the face of shallow declines that are quickly reversed. At the same time, the boom in investment vehicles designed around selling options pushes volatility lower.”

It’s possible that the upcoming presidential election will provide a catalyst for more volatility this fall. However, as earnings season wraps up and summer approaches, this period of low volatility could last for a few more months at least.

So, what’s an option seller to do?

First, don’t panic. At Traders Reserve, we’re still finding plenty of opportunities to collect premium, although we have to do more digging than usual. And, in some cases, we’re accepting less premium than we typically would. However, we’re also looking at supplementing our income with some options tactics that benefit from a low-volatility environment.

For instance, in the Income Masters program, we recently traded a diagonal call debit spread on Microsoft (MSFT).

How Diagonal Call Debit Spreads Work

A diagonal call debit spread is an options strategy that combines elements of a vertical debit spread and a calendar spread. It’s generally considered a neutral-to-bullish strategy that aims to benefit from a stock price increasing, but with limited risk and defined potential profit.

A vertical debit spread involves buying a call option (long call) at a certain strike price (usually lower) and simultaneously selling another call option (short call) with a higher strike price but the same expiration date. This limits your maximum profit but also caps your potential loss to the debit paid upfront (difference in price between the options).

A calendar spread involves buying a call option (long call) with a later expiration date and selling another call option (short call) with an earlier expiration date, both at the same strike price. This takes advantage of the fact that options with later expirations generally cost more than those with closer expirations (time value).

With a diagonal call debit spread, you buy a long call option with a lower strike price and a later expiration date and sell a short call option with a higher strike price but an earlier expiration date.

The strategy can yield profits whether the stock stays flat or increases over time.

If the stock price rises by the expiration of the short call, you can exercise your long call at a lower strike price and immediately sell it at the higher market price, locking in a profit.

You can also profit from time decay on the short call. As the short call nears expiration (assuming the stock price stays below the higher strike price), its time value will erode, benefiting the option seller.

MSFT Trade Pays Off in Low-Vol Environment

Microsoft is a stock we’ve traded on and off in the Income Masters program over the years, using a variety of strategies. Most recently, we’ve been selling put credit spreads to generate income due to the high share price.

However, during the May 21 live trading session, we noted that while we wanted to get back into a MSFT trade, the credit simply wasn’t there. So, we decided to go with a diagonal call debit spread.

Specifically, we entered the following trade:

Buy to open (BTO) MSFT 19 Jul 410 Call

Sell to open (STO) MSFT 7 Jun 435 Call

Rather than collect a credit as we typically do, we paid a debit of $23.40 to enter the trade. We traded two contracts in the live account, costing us $4,680 in total.

At the time we entered the trade, MSFT was trading just below the $430 level. We noted that we didn’t need a big run-up in shares to profit from the trade. Instead, we simply needed the stock to stay flat or move slightly higher to exit with a credit. Our goal was to make a 5% return in three to 10 days and then possibly reset the trade.

MSFT did, in fact, trade slightly higher over the ensuing days. And on May 24, we recommended that members set a good ‘til canceled (GTC) order to exit the spread for a credit of $24.65.

The GTC triggered that afternoon, allowing us to book a 5.3% return in just three days. During that time, Microsoft’s share price rose less than 1%.

We’re looking to get back into MSFT with another diagonal call debit spread this week. And we’ll continue to look for ways to profit in a low-volatility environment, adding new tactics to our trading arsenal when necessary.

While selling options remains our primary focus, the most successful traders are those who can adapt to what the market gives them.