We started off 2024 in Options Income Weekly by booking back-to-back winners on Novo Nordisk (NVO) and Roku (ROKU).

This was our third successful trade on Novo Nordisk in this service since early November. The pharmaceutical company has been generating a lot of buzz recently due to its diabetes and weight-loss drugs Ozempic and Wegovy.

Unless you’ve been living under a rock, you’ve heard of Ozempic. Everyone from Hollywood celebrities to your next-door neighbor is turning to it and other drugs like it to shed unwanted pounds.

The Danish drugmaker reported better-than-expected sales of Ozempic and Wegovy for the most recent quarter. This trend is likely to continue gaining steam in the new year, with Novo Nordisk predicting double-digit sales growth for both drugs.

NVO rose 57% in 2023, while many other pharmaceutical stocks lagged the broader market, as the company kept generating headlines and sales.

We’ve been using bullish investor sentiment and the buzz surrounding these popular weight-loss drugs to our advantage by selling options on Novo Nordisk.

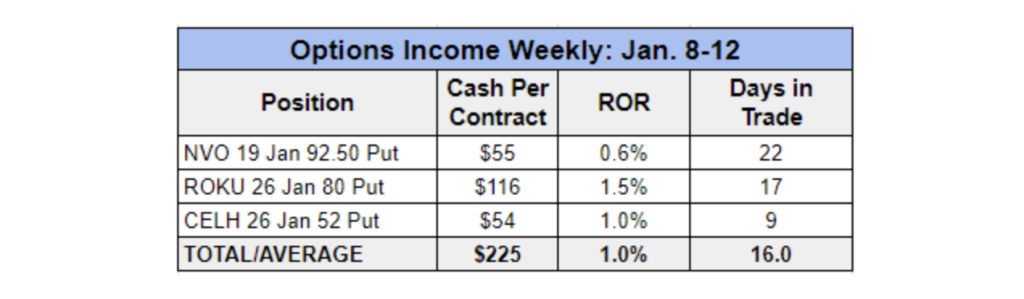

Most recently, Options Income Weekly members sold the NVO 19 Jan 92.50 Put on Dec. 17.

NVO popped on Jan. 4 on news the company inked two new R&D deals with biotech firm Omega Therapeutics (OMGA) as it seeks to keep up with skyrocketing demand for its obesity drugs.

Novo also announced a deal with privately held Cellarity to develop a treatment for a liver disease known as metabolic dysfunction-associated steatohepatitis (MASH) for which there is currently no approved treatment.

The pop in shares combined with theta decay to trigger our good ‘til canceled (GTC) order on Jan. 8 to buy back the put we sold.

Since we began trading NVO in November, we’ve earned an average rate of return of 0.6% per closed trade. That’s a respectable return for selling puts 6% to 12% out of the money.

Shortly after we exited our NVO trade, our ROKU 26 Jan 80 Put hit its target exit price thanks to a run-up in shares. We pocketed $116 in cash per contract, or nearly two-thirds of the max profit, and a 1.5% return on our capital well ahead of expiration.

Longtime Options Income Weekly members are very familiar with Roku, as we have been trading the TV streaming platform operator since late 2019. In 2023, we closed 10 winning trades on the stock, generating nearly $400 in cash with just one contract sold.

With NVO and ROKU closed on Monday, we immediately turned around and redeployed the capital during Tuesday’s Options Income Weekly live trading session.

In fact, we went right back to ROKU for one of our trades, given the stock’s attractive implied volatility rank (IVR) of 50.6 and the fact that the company is not scheduled to report earnings until mid-February.

Before we closed out the week, Options Income Weekly members closed out one more profitable trade on Celsius Holdings (CELH). This was our second winning trade on the popular energy drink maker in the past month.

All told, we pocketed $225 in cash for the week, averaging a 1% return per trade.

As earnings season kicks into high gear next week, we’re likely to see volatility pick up. But we’ll also need to be mindful of when companies are reporting to avoid having our positions run over by a big post-earnings move. So, we’ll be on the hunt for high IVR stocks that aren’t necessarily reporting in the coming days or weeks.