Nvidia (NVDA) was the best-performing stock in the S&P 500 in 2023, rising 239% as generative artificial intelligence became the next big thing and investors dove headfirst into shares of the graphics processing unit (GPU) maker.

The leader in AI hardware and software lived up to the hype, delivering strong growth and consistently beating analysts’ expectations.

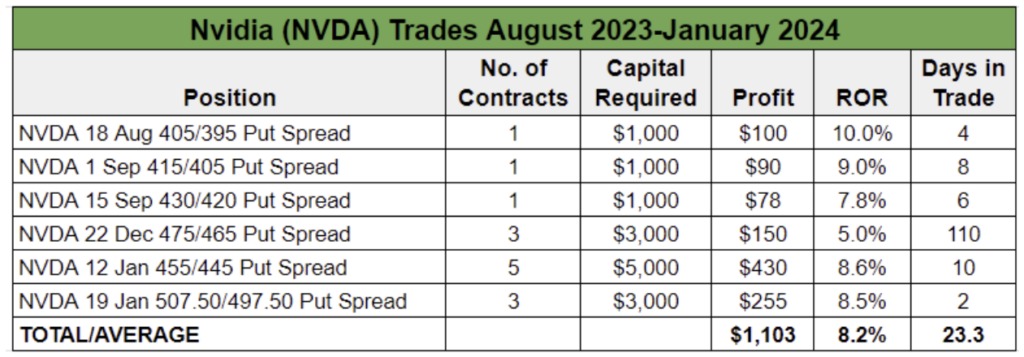

We traded the stock numerous times last year in the Income Masters program using a vertical bull put spread strategy, including a handful of Income Madness trades that yielded excellent short-term profits.

We did get stuck in one Nvidia trade for a few months, when the stock sold off sharply in September and October. However, we were able to actively manage the position back to a solid profit by rolling our put spread, even converting the position to an iron condor for a bit in order to generate additional cash.

Our persistence paid off, and we eventually booked a $150 profit and a 5% return for our efforts on a position that was well underwater at one point.

The day after we closed that recovery trade, we jumped right back in with another NVDA trade, which we closed 10 days later, pocketing $430 in income and earning an 8.5% return on our capital.

Nvidia’s bullish momentum has continued in the new year, with the stock up 10% while the broader market has struggled. Helping generate interest in NVDA shares this month was CES 2024.

The consumer electronics tradeshow, widely considered to be the biggest technology industry event of the year, kicked off Jan. 9, prompting us to put on a short-term CES-inspired Nvidia spread trade.

With the stock trading at $536.52, we entered three contracts of the NVDA 19 Jan 507.50/497.50 Put Spread on Jan. 9 for $1.15 each, or $3.45 total.

While we had 10 days to expiration (DTE), our hope was to exit the trade after just three or four days, anticipating that the buzz surrounding AI coming out of CES would give shares a boost.

We set a target exit price at $0.30 per spread, recommending that Income Masters members enter a good ‘til canceled (GTC) order at that level.

On Jan. 11, NVDA hit another record high after the company unveiled new AI offerings at CES 2024, including those focused on video games and automotive applications. Additionally, Oppenheimer analyst Rick Schafer reaffirmed his “outperform” rating on shares, calling NVDA one of his top semiconductor stock picks.

Our GTC to exit the spread filled at 2:52 p.m., allowing us to exit the trade with a $85 profit per spread, or $2.55 total for three contracts. Given that the spread was 10 points wide, our capital commitment for the three contracts we sold was just $3,000, meaning we earned an 8.5% return in just two days.

As you can see below, the return for our latest NVDA trade was in line with our average for trading the stock.

In total, we’ve earned more than $1,100 trading Nvidia over the past few months. Most of these trades have been short-term in nature. In fact, if you remove the recovery trade, our average holding time is just six days.

After booking a profit on Jan. 11, we immediately turned around and entered a new longer-term NVDA spread trade that is set to expire the week before the company announces earnings in mid-February.

We again went with a 10-wide, this time selling five contracts, for a net credit of around $1.15 each, or $5.75 total. We set our target exit price at $0.40 per spread, which will yield a 7.5% return on our capital if it is hit.

As the AI trend moves full steam ahead, we expect to see more opportunities to capture hefty premiums from this tech leader.